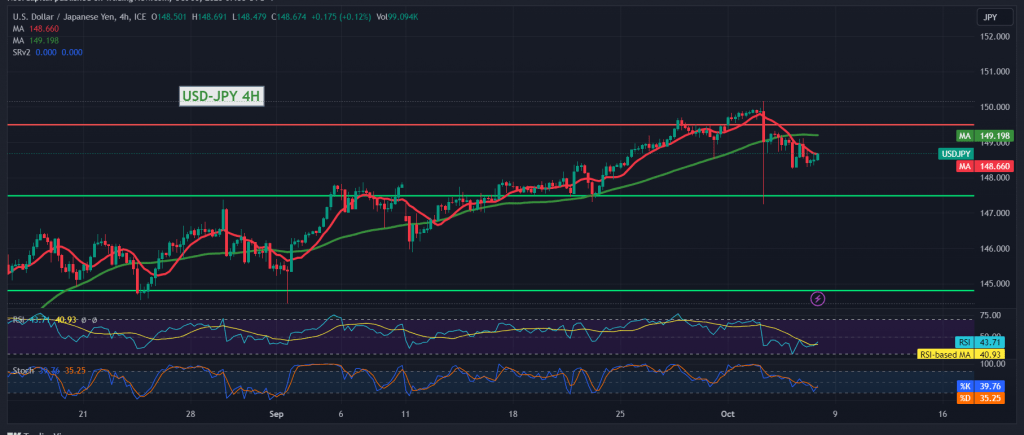

The resistance level mentioned in the previous technical report at 149.10, was able to put negative pressure on the USD/JPY pair, which forced it to trade with noticeable negativity within the expected bearish bias, approaching by a few points from the required target of 148.00, to be satisfied with recording the lowest level of 148.25.

On the technical side, today the pair’s intraday movements witnessed the trading stability below the previously broken support level converted to the 149.10 resistance level, accompanied by the beginning of the simple moving averages to put pressure on the price from above, in addition to the negativity of the 14-day momentum indicator.

From here, with the price remaining below the psychological barrier of 149.00, we may witness a bearish tendency aimed at retesting 148.00/148.20, a first target, knowing that sneaking below the level above will lead the pair to conduct an additional downward correction, with targets reaching 147.70 and 147.40, as long as trading remains stable below 149.10.

Note: Today, we are awaiting high-impact economic data issued by the American economy, “US jobs data (NFP), average wages and unemployment rates, and we may witness high price fluctuation when the news is released.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations