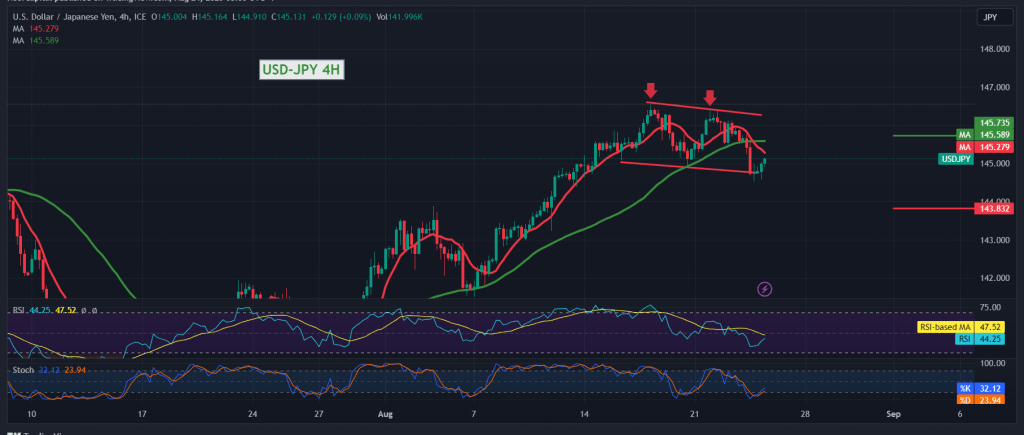

The negative pressure continues on the dollar-yen within the bearish corrective path published during the previous technical approach, within a gradual decline towards the first expected target of 145.30, to settle for recording its lowest price at 145.50.

The technical outlook remains unchanged, with the pair maintaining negative stability below the resistance level of 145.70/145.60, in addition to the bearish technical formation shown on the 4-hour chart.

We may witness a bearish inclination in the coming hours, targeting a retest of 144.40 as the first target, and breaking it may extend the losses, to be waiting for the next target of 143.80

From above, it crossed upwards, and the price consolidated above 145.70, leading the pair again to complete the bullish path, opening the door to visit 146.45.

Note: Today we are awaiting economic data from the summit of the “BRICS”, and “Jackson Hole Economic Forum”, and we may witness high price volatility.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations