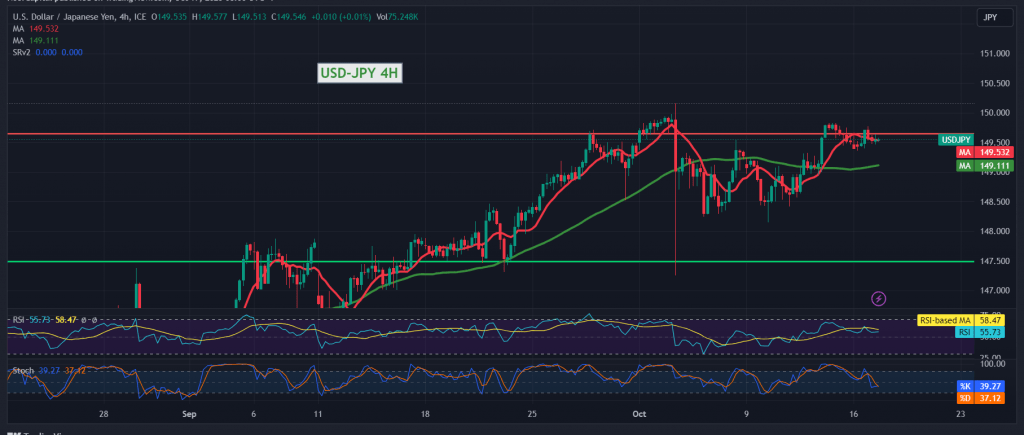

Quiet trading dominated the movements of the USD/JPY pair during the first trading of this week, and there was no significant change in the pair’s technical movements, maintaining the same trading levels mentioned in the previous report.

On the technical side today, we tend to be positive in our trading, but with caution, relying on the positive motivation coming from the simple moving averages and signs of positive momentum on short time frames.

We prefer to witness a clear and strong breakthrough and price consolidation above 150.00, as this is a motivating factor that opens the way towards 150.30 and then 150.80, respectively.

Stability and price consolidation again below 149.00 invalidates the activation of the bullish scenario. It leads the pair to the official path within a bearish correction procedure, with an initial target of 148.65 and extending towards 148.20.

Note: Today, we are awaiting high-impact economic data in the US, retail sales index and the annual core consumer price index from Canada, and we may witness high volatility at the time of the news release.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations