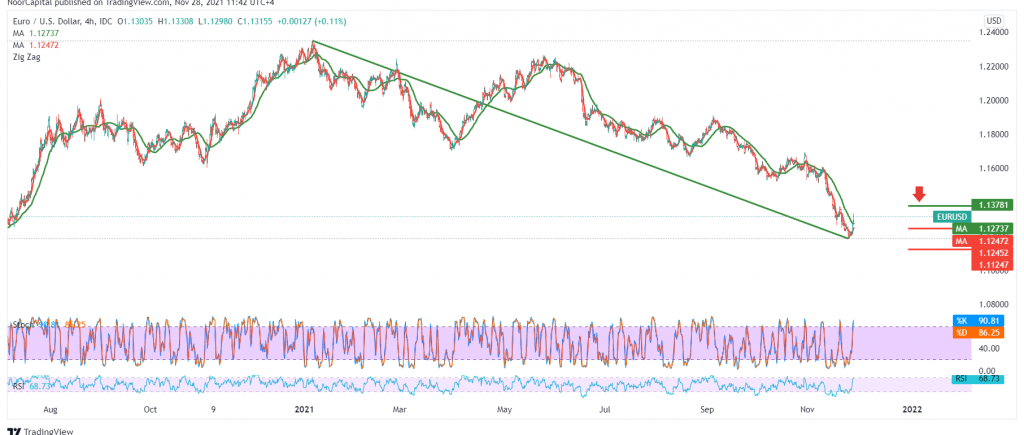

The single European currency managed to post good gains last week, building on a support level of 1.1200, which forced it to rebound within a limited upward slope to retest the 1.1330 resistance level.

Technically, and by looking at the 4-hour chart, the stochastic is now moving around the overbought areas. On the other hand, the moving averages have returned to the golden crossover to hold the price from below.

Although we tend to the bearish trend, the conflict of technical signals forces us to adhere to intraday neutrality until the expected price movement becomes clear, waiting for one of the following scenarios:

Confirmation of the breach of the strong resistance area 1.1330 is a catalyst that may lead to consolidating the euro’s gains to retest 1.1380/1.1375 before falling again.

Short positions require declining below the 1.1240 support level and stability below it. From here, the pair returns to the official bearish trend with the aim of 1.1160 and 1.1115 next stop.

| S1: 1.1240 | R1: 1.1360 |

| S2: 1.1160 | R2: 1.1405 |

| S3: 1.1115 | R3: 1.1480 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations