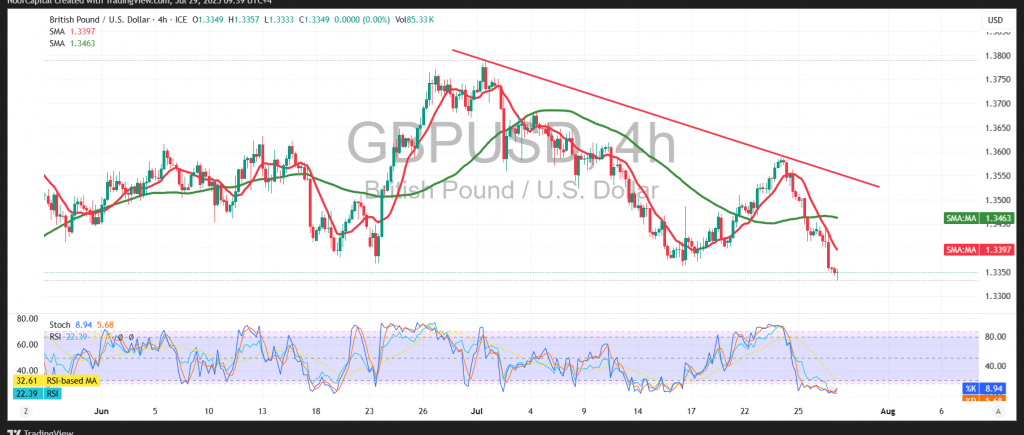

The GBP/USD pair has been dominated by a strong downward trend, with price action continuing within a descending wave that pushed the pair to a low of 1.3337.

Technical Outlook:

Intraday movements maintain a clear bearish bias, with price action adhering to a descending trendline, as illustrated on the chart. The Simple Moving Averages (SMAs) continue to exert downward pressure from above, reinforcing the prevailing bearish structure. Although the 14-period Momentum Indicator shows some early positive signs, they remain weak and insufficient to indicate a trend reversal at this stage.

Probable Scenario:

The bearish trend is likely to persist throughout today’s session. A confirmed break below the 1.3330 support level could accelerate downside momentum, paving the way toward the initial target at 1.3310. A further break below this level would likely extend the bearish wave toward the next support at 1.3265.

Alternative Scenario:

If the pair stabilizes above the 1.3425 resistance level, this may signal the beginning of a recovery attempt, with potential upside toward the 1.3490 level.

Warning: Market conditions remain highly volatile amid ongoing trade and geopolitical uncertainties. Traders should be prepared for rapid price fluctuations and multiple scenarios.

Disclaimer: Trading in CFDs carries inherent risks. The analysis provided herein is not a recommendation to buy or sell, but rather an interpretation of the current price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations