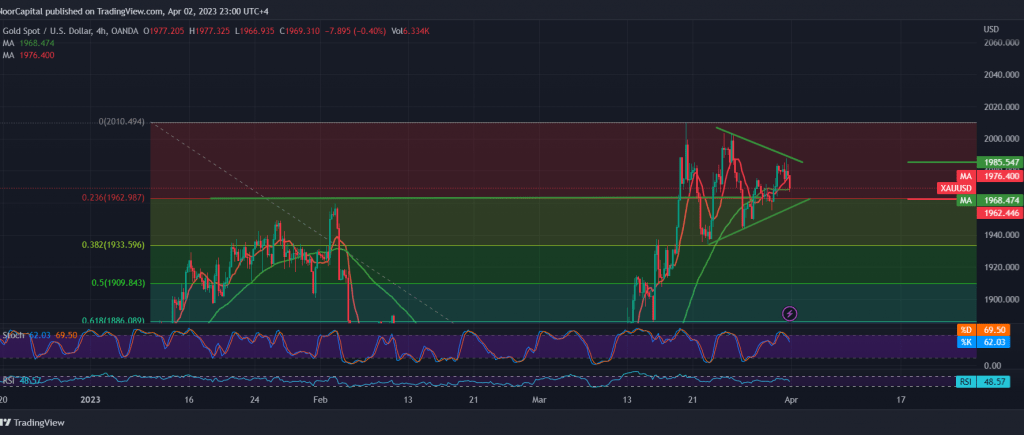

The yellow metal’s efforts continued to maintain its attempts to rise, which stopped temporarily due to the negative pressure from the 1987 resistance level, forcing the price to decline temporarily.

Technically, the overall bullish trend is still the most likely, relying on the stability of trading above the previously breached resistance level to 1960 support level, which represents the key to protecting the bullish trend on the simple moving average, providing a positive motive in addition to the bullish technical formation shown on 4-hour charts.

Therefore, with stable trading above 1960, the bullish scenario remains the most preferred, knowing that the price’s consolidation above 1986 facilitates the task required to visit the psychological level of 2000. It is worth paying close attention that the closing of the 4-hour candlestick above 2000 increases and accelerates the strength of the overall bullish trend opening the door toward 2020 initially.

The break of 1960 leads gold prices to decline on an intraday basis, so we will be waiting for an ounce of gold around 1942 and then 1938.

Note: the risk level is high

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations