The price of gold experienced a positive trading session, reaching significant gains and continuing its upward trajectory to achieve new historical peaks, with a peak at $2222 per ounce.

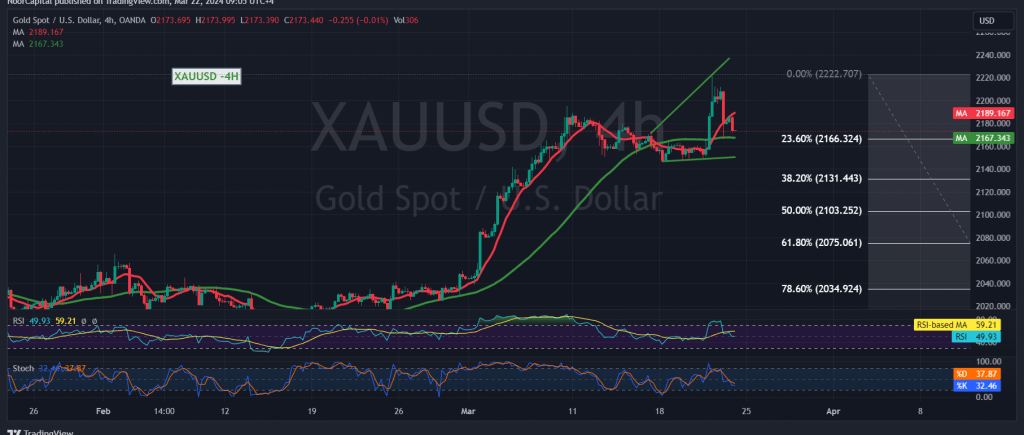

In terms of technical analysis today, observing the 240-minute timeframe chart, the upward movement halted after reaching $2222, and the price began to undergo some corrective downward movement towards $2166. The simple moving averages continue to support the upward trend, accompanied by positive signals from the Stochastic indicator, indicating potential further upward momentum.

With intraday trading maintaining levels above $2166, the upward trend remains the most likely scenario, with a target of $2208. Breaking above this level would likely lead to a continuation towards the awaited peaks of $2222 and $2240.

However, should the price fall below $2166 (Fibonacci retracement 23.60%), it could face temporary negative pressure, targeting a corrective decline towards $2152 and $2131 (retracement 38.20%).

Warning: Today’s trading may be influenced by a speech from Jerome Powell, Governor of the Federal Reserve, potentially leading to increased price volatility.

Warning: The level of risk is high due to ongoing geopolitical tensions, which may result in heightened price volatility.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations