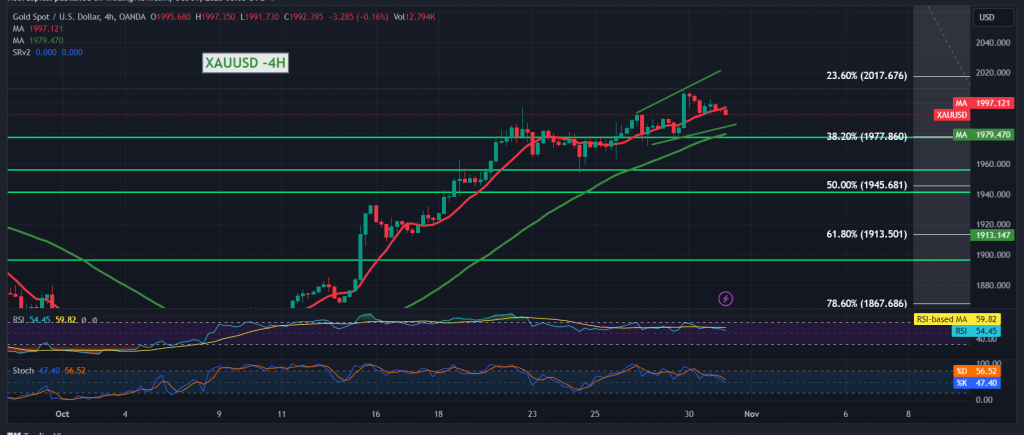

Gold prices experienced subdued trading, predominantly following a slight downward trajectory, reaching its lowest point at $1,990 per ounce in the initial trading sessions of the week.

From a technical perspective, today saw gold prices exerting downward pressure, particularly around the $1,995 mark. Additionally, both the Stochastic indicator and the Relative Strength Index began displaying negative signals. These indicators suggest a potential bearish trend in the upcoming hours, with expected targets at $1,986 and $1,977, representing the 38.20% Fibonacci retracement. It’s noteworthy that this bearish sentiment doesn’t contradict the overall upward trend. Upon breaching the resistance level at $2,002, the official targets for the upward trend are set around $2,012 and $2,017.

It’s important to highlight that despite the current market conditions, the simple moving averages remain positive, indicating that the broader trend remains optimistic.

Please take note that today, the market is awaiting significant economic data from both the US, including the Consumer Confidence Index, and Canada, particularly the monthly gross domestic product. There might be substantial price fluctuations when these news releases occur.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations