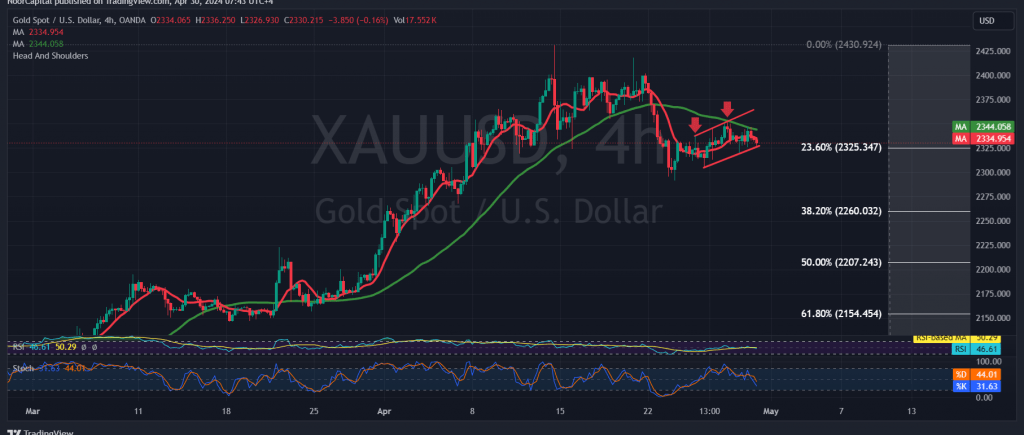

Gold prices recently found robust support at $2325, a level crucial for maintaining the short-term upward trend. This support prompted a modest rebound, with prices reaching a peak of $2346 per ounce.

Analyzing the 240-minute time frame chart reveals a return to stability below the 50-day simple moving average, reinforcing the bearish sentiment observed on the daily price curve. This coincides with a decline in upward momentum indicated by the Stochastic indicator.

Consequently, the likelihood of a resumption in the downward corrective movement is high, particularly upon a breach of the pivotal support at $2325, corresponding to the 23.60% Fibonacci retracement. This could open the path towards levels at $2304 and $2290, with a primary target for breaking the support set around $2260.

It’s worth noting that a sustained move above $2345, coupled with at least an hour candle closing, could mitigate losses, potentially leading to a retest of $2360 and further gains towards $2370.

Traders should exercise caution, as today’s trading session is marked by the release of high-impact economic data from the American economy, including the “Employment Cost Index” and “Consumer Confidence Index.” This could result in heightened price volatility.

Additionally, geopolitical tensions persist, further elevating the level of risk and potentially contributing to increased price fluctuations.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations