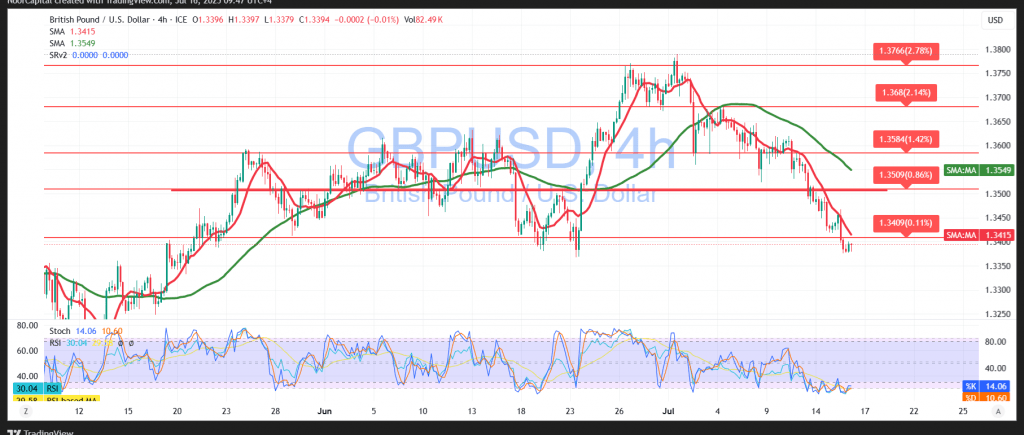

The British pound continued its gradual decline against the U.S. dollar, in line with previous technical expectations. During the last session, the pair recorded a new low at 1.3378, approaching the projected support target at 1.3370.

Technical Outlook – 4-Hour Timeframe:

Bearish pressure remains evident, with the simple moving averages acting as dynamic resistance, capping any recovery attempts. The 50-period moving average currently aligns with the 1.3460 resistance zone, reinforcing its role as a key technical barrier. However, the Relative Strength Index (RSI) is showing positive crossover signals from oversold territory, indicating a potential for a short-term rebound.

Likely Scenario – Bearish Bias:

As long as the pair remains below 1.3450, and more importantly 1.3460, the downward trend is expected to continue. A confirmed break below 1.3360 would likely accelerate losses, with downside targets at 1.3320, followed by 1.3270.

Alternative Scenario – Temporary Recovery:

If the pair breaks above 1.3460 and stabilizes, this could signal a short-term bullish correction, with upside potential toward a retest of 1.3505.

Market Catalyst:

Traders should prepare for increased volatility as the market awaits the release of high-impact U.S. economic data, including monthly and annual Core Producer Price Index (PPI) figures.

Caution:

Amid ongoing geopolitical and trade tensions, risk remains elevated. All outcomes are possible, and disciplined risk management is strongly advised.

Disclaimer: Trading in CFDs carries inherent risks. The analysis provided herein is not a recommendation to buy or sell, but rather an interpretation of the current price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations