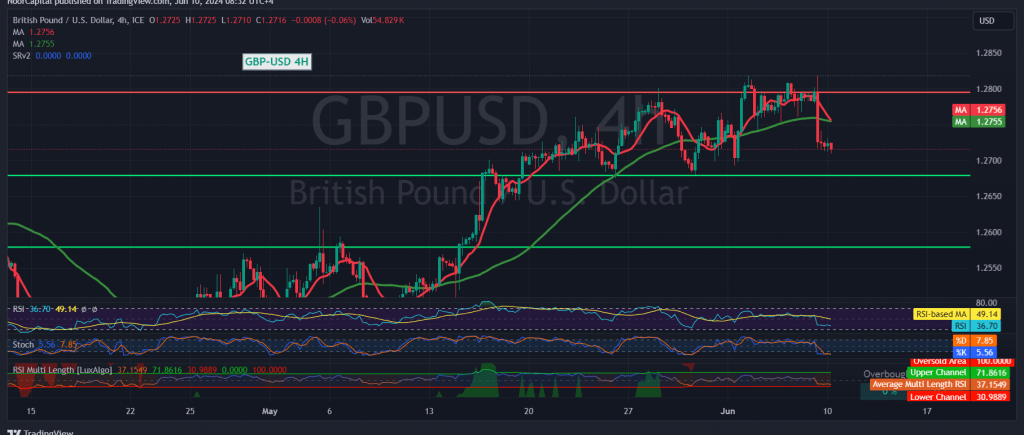

The British pound surrendered its recent gains against the U.S. dollar following the release of strong U.S. jobs data, triggering a downward move and retesting the critical 1.2700 support level.

Technical indicators now suggest a bearish bias for the GBP/USD pair. On the 4-hour chart, the simple moving averages have crossed over, indicating downward pressure. Additionally, the Relative Strength Index (RSI) remains below the 50 midline, reinforcing the negative sentiment.

While the bearish scenario seems likely for today’s trading, the 1.2700 support level will be crucial in determining the pair’s future direction. A decisive break below this level could accelerate the downward momentum, pushing the pair towards 1.2675 initially and potentially further down to 1.2640.

However, if the price manages to consolidate above 1.2700 and break through the 1.2785 resistance level, it could signal a resumption of the upward trend. In this case, the pair could target 1.2855 and even 1.2890.

Traders are advised to closely monitor the price action around the 1.2700 level, as it could serve as a pivotal point for the GBP/USD pair. A break below this support could trigger further losses, while a hold above it could potentially lead to a bullish reversal.

Disclaimer: Trading in CFDs carries inherent risks. The analysis provided herein is not a recommendation to buy or sell, but rather an interpretation of the current price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations