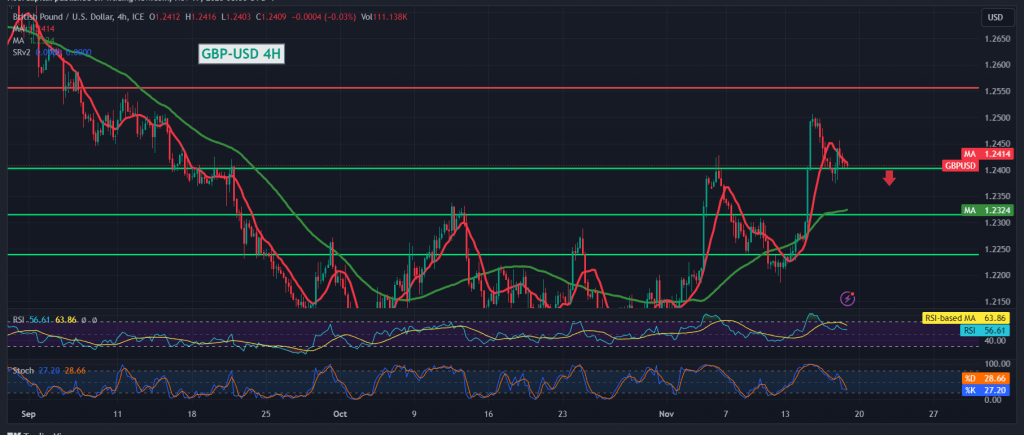

Limited positive attempts characterized the movements of the British pound against the US dollar, encountering formidable resistance at the previously identified level of 1.2465, as outlined in the preceding report. This resistance effectively curtailed the upward momentum.

Upon closer examination of the 4-hour chart, signs of negativity persist on the Stochastic indicator, indicating a waning upward momentum. Additionally, the Relative Strength Index (RSI) remains stable below the 50 midline.

Consequently, the potential for a bearish bias in the upcoming hours remains both valid and influential. Notably, slipping below 1.2390 would likely facilitate a move towards the targets of 1.2330 and 1.2290.

It’s important to reiterate that a significant upward surge and consolidation above 1.2465 would completely invalidate the activation of the bearish scenario. Instead, it would propel the pair towards recovery, targeting 1.2500 and 1.2540.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations