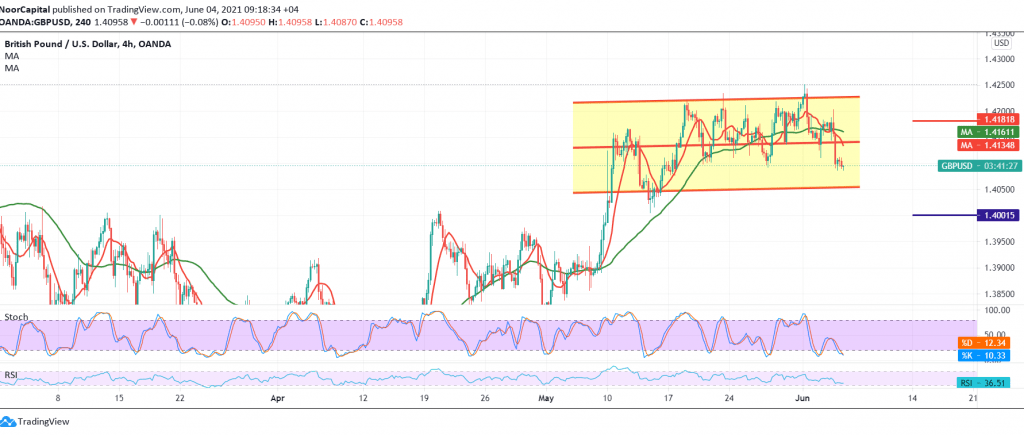

The resistance levels published during the previous analysis, located at 1.4180, were able to stop the bullish bias, which forced the pound sterling to decline again, as we expected to touch the official target that is required to be achieved around 1.4070, recording the lowest price during the early trading of the current session, around 1.4082.

On the technical side, the RSI started sending negative signals today, coinciding with the return of the 50-day moving average to pressure the price from above.

From here and steadily intraday trading below 1.4165 and in general below 1.4180, the bearish tendency is likely today, knowing that confirming the break of 1.4070 facilitates the task required to visit 1.4040 and 1.4010 respectively, and it should be noted that trading below 1.4000 forces the pair to enter into a strong selling wave whose target Initial 1.3970.

Skipping up and rising again above 1.4180/1.4190 will stop the bearish scenario, and we may witness a slight bullish bias with an initial target of 1.4240.

| S1: 1.4050 | R1: 1.4165 |

| S2: 1.4010 | R2: 1.4240 |

| S3: 1.3940 | R3: 1.4280 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations