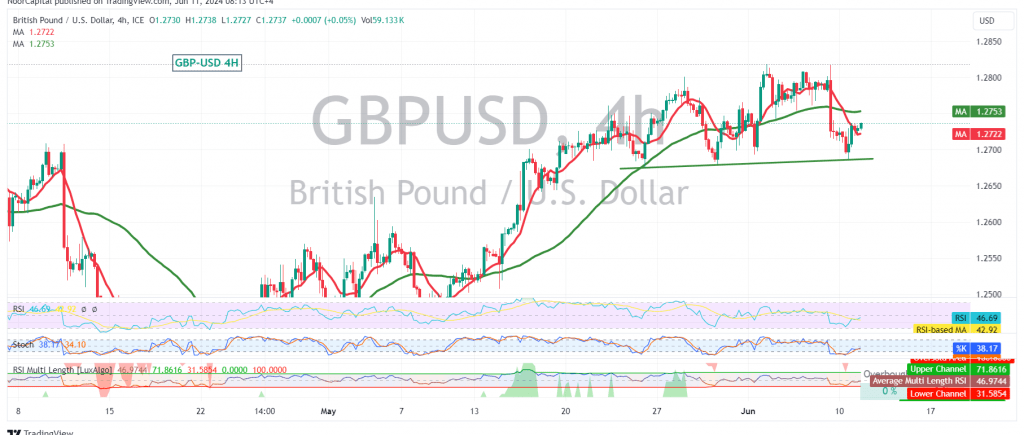

The British pound (GBP) continued its upward trajectory against the US dollar (USD), reaching our previously identified target of 1.2830 and peaking at 1.2861. However, current movements are showing a bearish tendency as the pair struggles to hold above the psychological resistance level of 1.2800. The Stochastic oscillator also indicates overbought conditions, suggesting a potential reversal. Despite these bearish signals, the pair remains above the crucial support level of 1.2700, and the simple moving averages continue to provide positive support.

Outlook and Trading Strategy

We maintain a cautiously optimistic outlook, contingent on the pair’s ability to hold above 1.2700. If this support level remains intact, a successful consolidation above 1.2855 could pave the way for further gains towards 1.2920 and 1.2960.

However, traders should exercise caution as a drop below 1.2700 would invalidate the bullish scenario and could trigger a decline towards 1.2665 and 1.2630.

Important Note

The release of high-impact U.S. economic data today, including annual producer prices and basic monthly/annual producer prices excluding energy and food, could induce significant price volatility. Traders should closely monitor the market’s reaction to these data releases.

Key Levels:

- Support: 1.2700

- Resistance: 1.2800, 1.2855

Disclaimer: Trading in CFDs carries inherent risks. The analysis provided herein is not a recommendation to buy or sell, but rather an interpretation of the current price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations