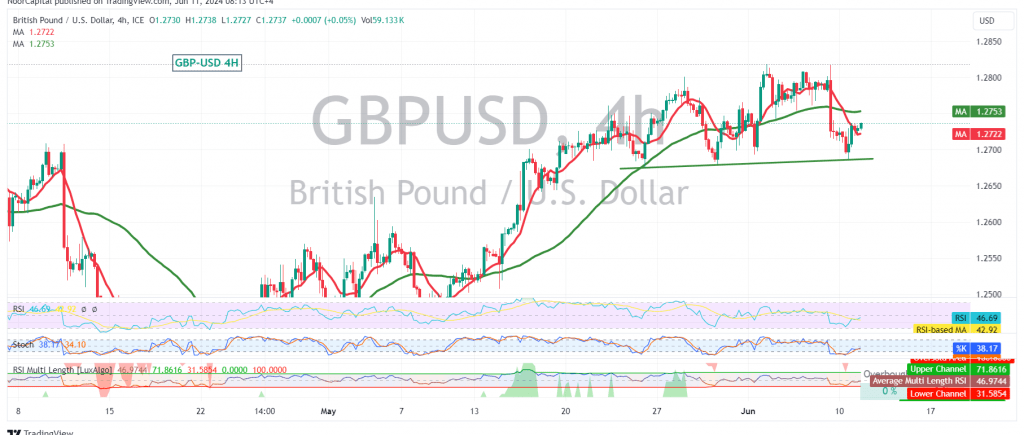

The British pound (GBP) has shown resilience against the US dollar (USD), finding support at the pivotal 1.2700 level we highlighted in our previous report. This positive development, along with attempts to push higher, suggests a potential shift towards an upward trend.

On the technical side, the GBP/USD pair closed above 1.2700 in the previous session. The Stochastic oscillator indicates a potential surge in momentum, which could propel the pair further upwards.

While we lean towards a positive outlook, caution is warranted. A decisive break above 1.2750 would open the door for a move towards 1.2780, followed by 1.2830.

However, traders should be vigilant. A drop below 1.2700 would invalidate the bullish scenario and could trigger a decline towards 1.2630.

Key Points:

- The GBP/USD pair shows signs of a potential uptrend.

- The 1.2750 level is a crucial resistance to watch.

- Traders should consider long positions cautiously, with appropriate stop-loss orders.

- A break below 1.2700 could trigger a reversal of the current bullish sentiment.

Disclaimer: Trading in CFDs carries inherent risks. The analysis provided herein is not a recommendation to buy or sell, but rather an interpretation of the current price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations