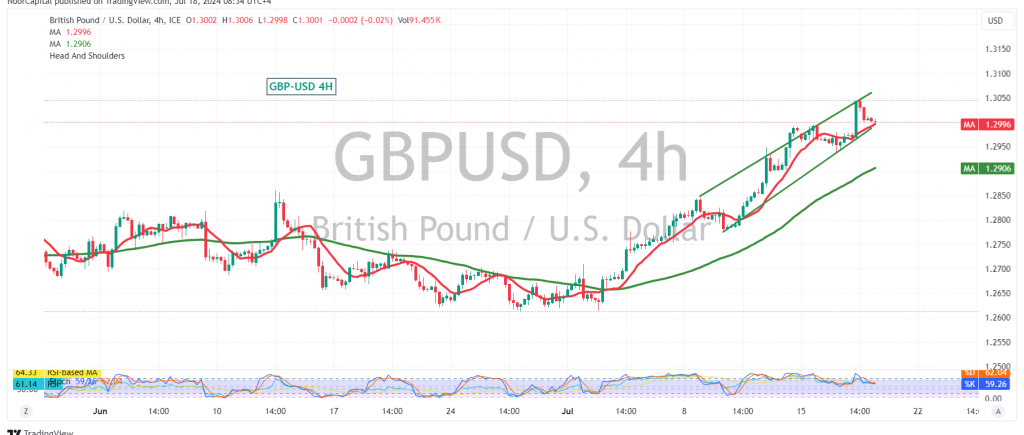

The British pound (GBP) continues its upward trajectory against the US dollar (USD), reaching our second target of 1.3030 and peaking at 1.3045. The bullish trend remains firmly in place.

Technical Outlook:

On the 4-hour chart, the simple moving averages (SMAs) are providing continued support for the upward price movement, suggesting further upside potential.

Upward Potential:

With the price holding above the 1.2960 support level, we expect the upward trend to persist. Our revised target is now 1.3040, and a break above this level could accelerate the rally towards 1.3080 and 1.3120.

Downside Risks:

Traders should remain cautious, however, as a break below 1.2960 could trigger a temporary correction and put the pair under negative pressure, potentially leading to a retest of the pivotal support at 1.2920.

Key Levels:

- Support: 1.2960, 1.2920

- Resistance: 1.3040, 1.3080, 1.3120

Important Note:

The release of high-impact economic data from the European Central Bank today, including the Monetary Policy Committee statement, interest rate decision, and press conference by the President, could induce significant price volatility. Traders are advised to closely monitor the market’s reaction to these data releases.

Disclaimer: This analysis is for informational purposes only and should not be considered as financial advice.

Disclaimer: Trading in CFDs carries inherent risks. The analysis provided herein is not a recommendation to buy or sell, but rather an interpretation of the current price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations