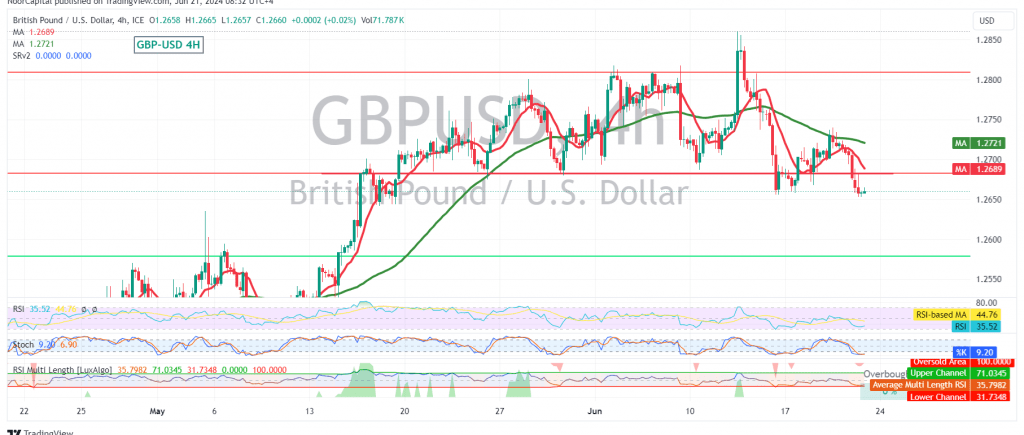

The British pound (GBP) experienced a decline against the US dollar (USD) yesterday, following the Bank of England’s (BoE) interest rate decision. The pair broke below the key 1.2700 support level, signaling a potential shift towards a bearish trend.

Technical Outlook:

Today’s technical analysis reveals that the GBP/USD pair is trading below the 1.2700 psychological resistance level, with the simple moving averages (SMAs) now exerting downward pressure on the price.

Downward Potential:

The current bias is bearish, with an initial target of 1.2630. If this level is breached, the pair could face further downward pressure, potentially reaching 1.2580.

Potential Reversal:

However, a close above the previously broken 1.2700 support level could postpone the downside and lead to a recovery, targeting 1.2750 and 1.2780.

Key Levels:

- Resistance: 1.2700, 1.2750, 1.2780

- Support: 1.2630, 1.2580

Important Note:

The release of high-impact economic data today, including the services and manufacturing PMI indices from France, Germany, England, and the United States, could induce significant price volatility. Traders are advised to exercise caution and closely monitor market reactions to these data releases.

Disclaimer: Trading in CFDs carries inherent risks. The analysis provided herein is not a recommendation to buy or sell, but rather an interpretation of the current price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations