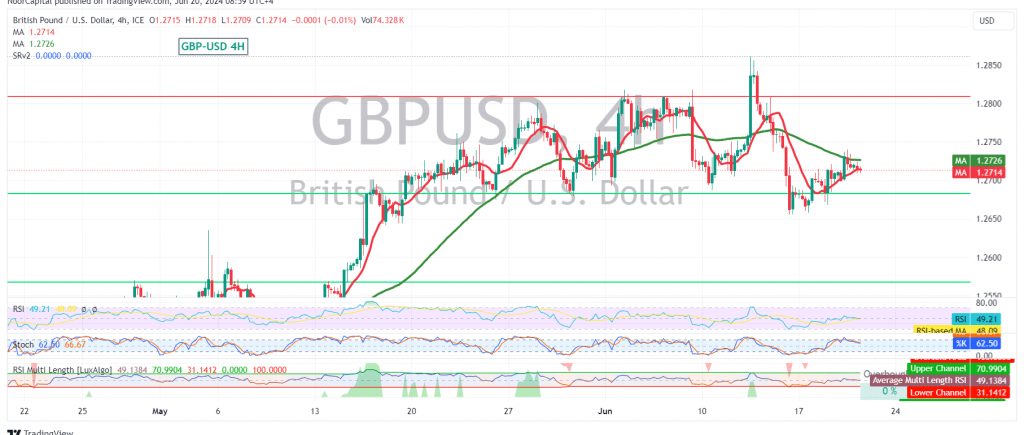

The British pound (GBP) has remained relatively stable against the US dollar (USD), trading within a narrow range bounded by the 1.2700 support level and the 1.2730 resistance level.

Technical Outlook:

Despite the sideways movement, the price holding above 1.2700 indicates a positive bias. However, the 50-day simple moving average continues to exert downward pressure, suggesting caution is warranted.

Upward Potential:

We maintain a cautiously optimistic outlook, with a potential upside break if the pair can decisively surpass the 1.2750 resistance level. This could pave the way for further gains towards 1.2780 and 1.2830, with a possible extension to 1.2870.

Downside Risks:

Conversely, a break below 1.2700 would invalidate the bullish scenario and trigger a bearish trend, potentially targeting 1.2630 and 1.2580.

Key Levels:

- Support: 1.2700, 1.2630, 1.2580

- Resistance: 1.2730, 1.2750, 1.2780, 1.2830, 1.2870

Important Note:

Today’s release of high-impact economic data, including the interest rate decision, monetary policy summary, and Monetary Policy Committee vote on interest rates from the British economy, as well as unemployment benefits data from the U.S. economy, could lead to significant price volatility. Traders should closely monitor the market’s reaction to these data releases.

Disclaimer: Trading in CFDs carries inherent risks. The analysis provided herein is not a recommendation to buy or sell, but rather an interpretation of the current price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations