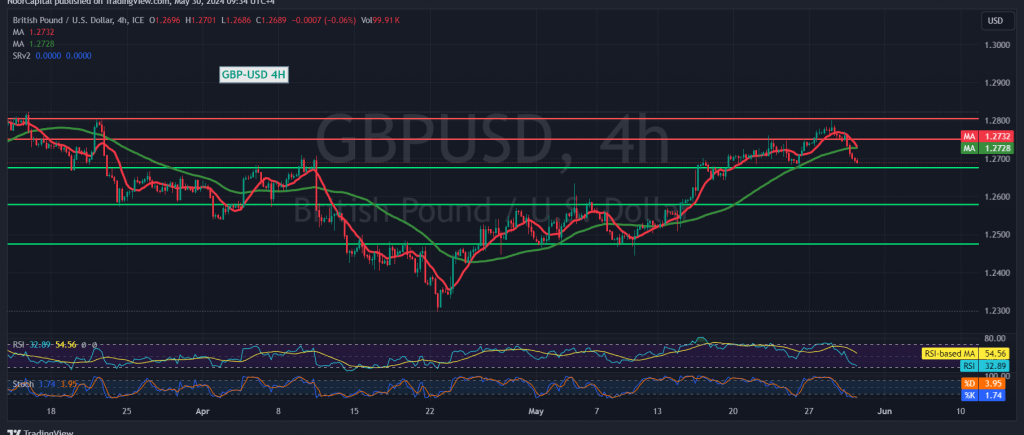

The British pound is facing pressure against the U.S. dollar, approaching the previously identified support level of 1.2700. The pair is currently trading around 1.2692, suggesting a potential bearish bias for today’s session.

Technical indicators support this bearish outlook. The simple moving averages have crossed over, indicating a shift in momentum to the downside. Additionally, the Stochastic oscillator has lost its upward momentum, further reinforcing the bearish sentiment.

Therefore, a downward move is likely to occur in the coming hours, with the initial target set at 1.2665, followed by 1.2630 as the next key level.

However, traders should remain cautious as a decisive move above 1.2700, with an hourly candle close above this level, could invalidate the bearish scenario. This would signal a continuation of the bullish trend, with potential targets at 1.2745 and even 1.2800.

It’s important to note that today’s high-impact economic data releases from the U.S. economy, such as unemployment benefits and the preliminary reading of quarterly GDP, could introduce significant volatility into the market.

Traders are advised to closely monitor these developments and adjust their strategies accordingly. While the current technical picture leans towards a bearish bias, a bullish reversal remains possible depending on the price action around the 1.2700 level and the impact of upcoming economic data.

Disclaimer: Trading in CFDs carries inherent risks. The analysis provided herein is not a recommendation to buy or sell, but rather an interpretation of the current price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations