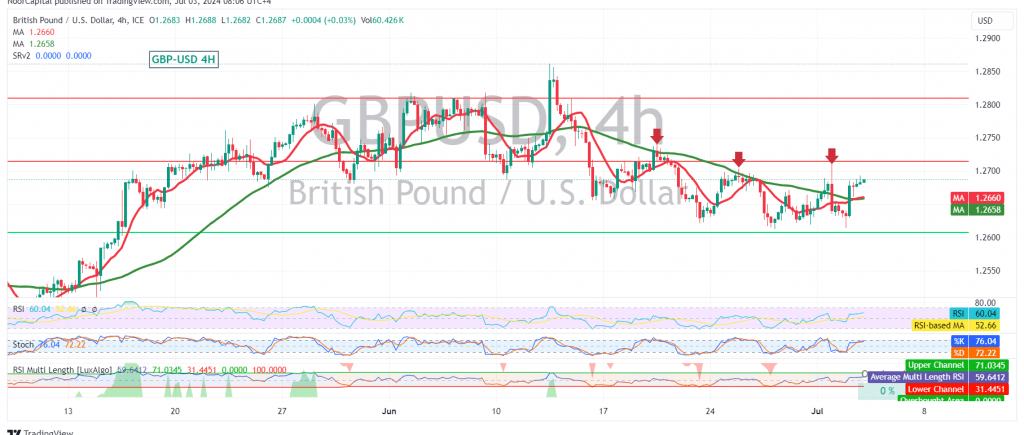

The British pound (GBP) showed mixed trading with a positive bias against the US dollar (USD) in recent sessions, bouncing off the 1.2600 support level and attempting to retest the key 1.2700 resistance.

Technical Outlook:

The GBP/USD pair is currently consolidating below the 1.2700 psychological resistance level. While the Stochastic oscillator is nearing overbought territory, suggesting a potential pullback, the simple moving averages (SMAs) have turned supportive, indicating possible upward momentum.

Potential Scenarios:

Given the conflicting signals, close monitoring of price action is essential. Two scenarios are possible:

- Upward Breakout: A decisive break above 1.2700, and more importantly, above 1.2710, would confirm a bullish trend reversal. This could propel the pair towards 1.2750 and potentially 1.2790.

- Downward Continuation: A failure to break above 1.2700 could lead to a continuation of the downward trend, targeting the 1.2585 support level.

Key Levels:

- Resistance: 1.2700, 1.2710, 1.2750, 1.2790

- Support: 1.2600, 1.2585

Important Note:

The release of high-impact U.S. economic data today, namely the ADP Non-Farm Employment Change report, could trigger significant price volatility. Traders should exercise caution and closely monitor the market’s reaction to this news.

Disclaimer: Trading in CFDs carries inherent risks. The analysis provided herein is not a recommendation to buy or sell, but rather an interpretation of the current price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations