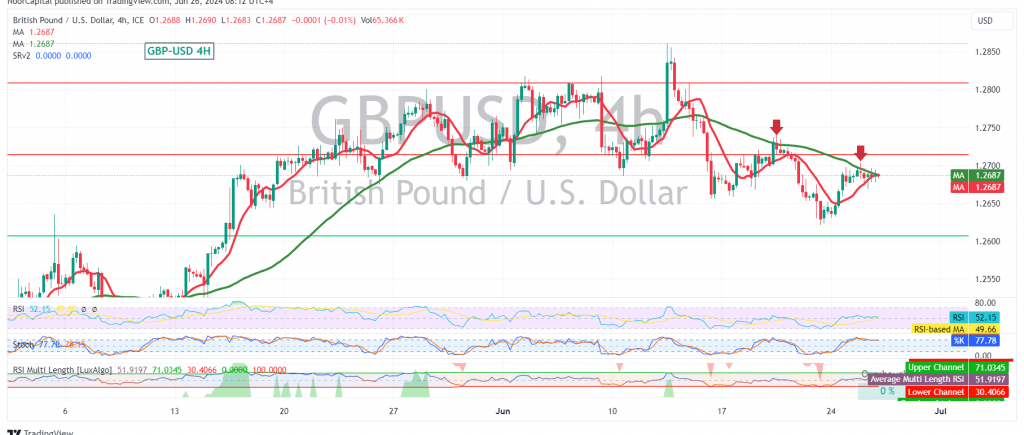

The British pound (GBP) continues to exhibit negative stability against the US dollar (USD), remaining below the key psychological resistance level of 1.2700.

Technical Outlook:

The current technical outlook remains bearish, with the pair consolidating below 1.2700. The simple moving averages (SMAs) are exerting downward pressure, and the Stochastic oscillator is also showing negative signals, further reinforcing the bearish sentiment.

Downward Potential:

The expected trend for today’s trading session is bearish, with an initial target of 1.2630. A break below this level could intensify the downward pressure, potentially leading the pair towards 1.2580.

Potential Reversal:

However, traders should be aware that a close above 1.2700, and more importantly, above 1.2720, could invalidate the bearish scenario and trigger a potential recovery. In this case, the pair could target 1.2750 and 1.2790.

Key Levels:

- Resistance: 1.2700, 1.2720, 1.2750, 1.2790

- Support: 1.2630, 1.2580

Disclaimer: Trading in CFDs carries inherent risks. The analysis provided herein is not a recommendation to buy or sell, but rather an interpretation of the current price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations