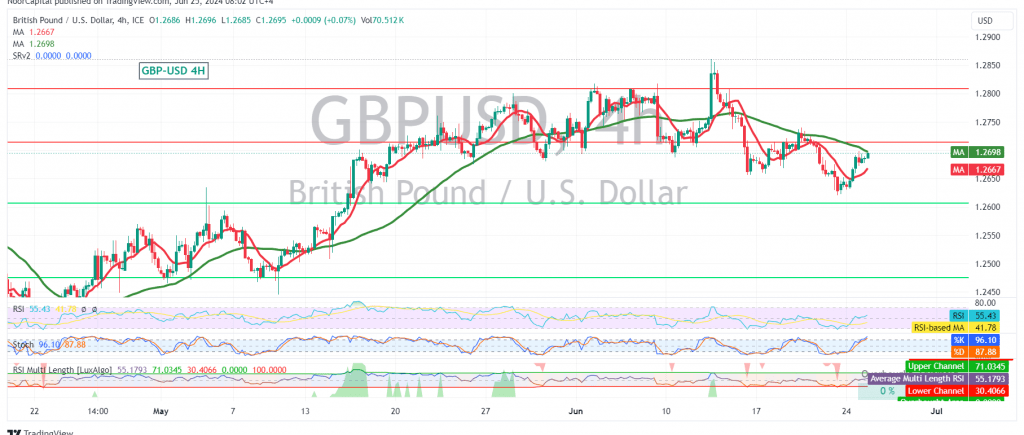

The British pound (GBP) showed positive movement against the US dollar (USD) in the previous session, attempting to break through the 1.2700 resistance level. However, it failed to consolidate above this level and is now facing downward pressure.

Technical Outlook:

Today’s technical analysis reveals that the GBP/USD pair is trading below the 1.2700 resistance level, with the simple moving averages (SMAs) now exerting downward pressure on the price. Additionally, the Stochastic oscillator has lost its upward momentum, further supporting the bearish sentiment.

Downward Potential:

The current bias is negative, with an initial target of 1.2630. If this level is breached, the pair could face significant downward pressure, potentially reaching 1.2580.

Potential Reversal:

However, a close above 1.2700, and more importantly, above 1.2720, could postpone the downside and lead to a recovery, targeting 1.2750 and 1.2790.

Key Levels:

- Resistance: 1.2700, 1.2720, 1.2750, 1.2790

- Support: 1.2630, 1.2580

Important Note:

The release of the U.S. Consumer Confidence Index today could significantly impact the pair’s movement. Traders should exercise caution and closely monitor the market’s reaction to this data.

Disclaimer: Trading in CFDs carries inherent risks. The analysis provided herein is not a recommendation to buy or sell, but rather an interpretation of the current price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations