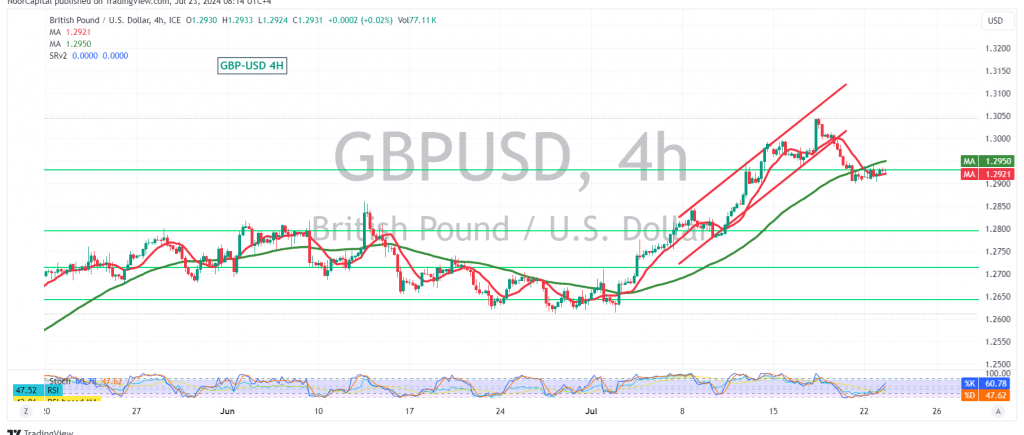

The British pound (GBP) experienced narrow sideways trading against the US dollar (USD) yesterday, remaining confined between 1.2900 and 1.2945.

Technical Outlook:

On the 4-hour chart, the Stochastic oscillator is showing signs of weakening upward momentum and is beginning to generate negative crossover signals. This, combined with the price stabilizing below the pivotal resistance level of 1.2945, suggests a potential bearish bias.

Downside Potential:

If the bearish bias materializes, a break below 1.2890 could trigger a decline towards the initial target of 1.2860, followed by a potential move towards 1.2800.

Upside Potential:

However, traders should be aware that a break above 1.2950 and subsequent consolidation could invalidate the bearish scenario. In this case, the pair could retest the 1.3000 level.

Key Levels:

- Resistance: 1.2945, 1.2950

- Support: 1.2900, 1.2890, 1.2860, 1.2800

Conclusion:

The GBP/USD pair is currently exhibiting narrow range trading with a potential bearish bias. Traders should closely monitor the price action around the key levels mentioned above and wait for a clear breakout or breakdown confirmation before taking any positions.

Disclaimer: Trading in CFDs carries inherent risks. The analysis provided herein is not a recommendation to buy or sell, but rather an interpretation of the current price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations