GBP/USD: Bullish Momentum Remains Intact, but Caution Warranted

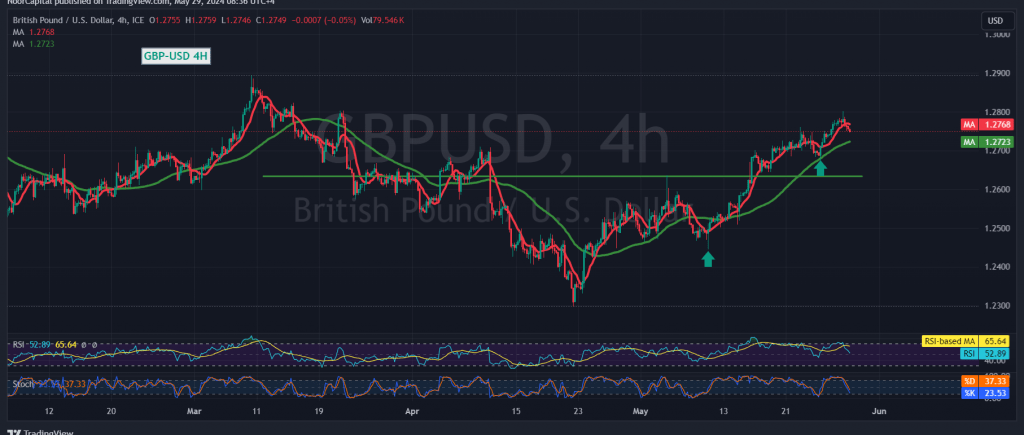

The British pound successfully reached its initial target of 1.2800, as outlined in the previous technical analysis. However, this level proved to be a formidable resistance, prompting a minor pullback. The currency pair is currently consolidating around 1.2745.

Technical indicators suggest that the bullish momentum remains intact. On the 4-hour chart, the price is holding above the 50-day simple moving average, which lends support to the upward trend. Additionally, the 14-day Momentum indicator continues to flash positive signals, reinforcing the bullish outlook.

As long as the pair remains above the 1.2700 support level, the upward trend is likely to persist, with a retest of the 1.2800 resistance level on the cards. A successful break above this level could unleash further buying pressure, potentially propelling the pair towards 1.2840 and even 1.2880.

However, traders should exercise caution. A decisive move below the 1.2700 psychological support could invalidate the current bullish scenario and expose the pair to downside risks. In such a scenario, the 1.2675 and 1.2640 levels could become potential targets for the bears.

Overall, the technical picture for GBP/USD remains constructive, but traders should remain vigilant and closely monitor price action around key levels to gauge the strength of the prevailing trend.

Disclaimer: Trading in CFDs carries inherent risks. The analysis provided herein is not a recommendation to buy or sell, but rather an interpretation of the current price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations