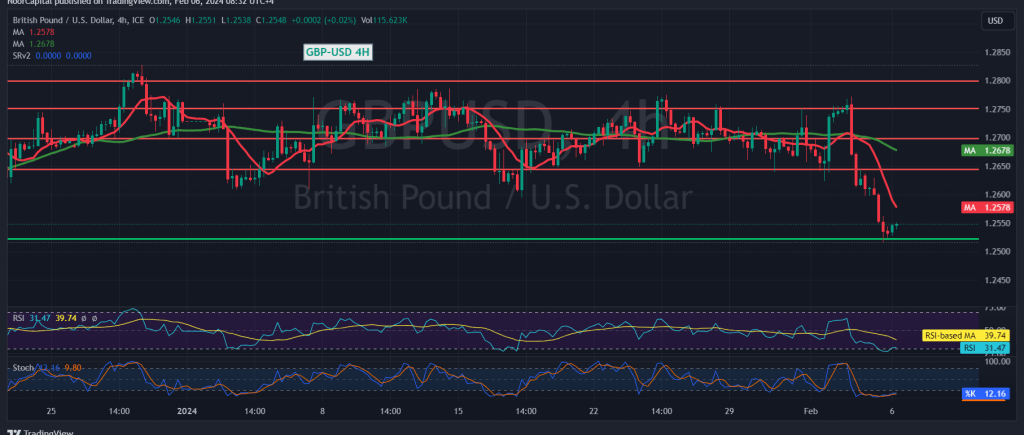

The British pound (GBP) experienced notable losses against the US dollar (USD) in the previous trading session, triggered by the breach of the critical support level at 1.2660. This breach has intensified negative pressure on the pair, driving it towards lower levels, with the lowest point recorded at 1.2520.

Market Dynamics

Breakdown of Key Support Level

The GBP/USD pair witnessed a significant downturn as it breached the crucial support level at 1.2660. This breach has intensified selling pressure, paving the way for further declines in the pair’s value.

Technical Analysis

Bearish Bias and Resistance Levels

From a technical perspective, the prevailing sentiment leans towards negativity in trading activities. Key technical indicators support this bearish bias, notably:

- Conversion of Support to Resistance: The previously breached support level at 1.2660 has now transformed into a resistance level, exerting downward pressure on the pair.

- 50-Day Simple Moving Average (SMA): The pair is trading below the 50-day SMA, further reinforcing the bearish outlook. Additionally, the SMA aligns closely with the psychological barrier resistance at 1.2600.

Potential Scenarios and Targets

Bearish Scenario

The bearish scenario remains the most preferable, with the pair targeting the 1.2500 level. A breakthrough below this level could amplify losses, opening the path towards subsequent targets at 1.2450 and 1.2380.

Recovery Scenario

Conversely, a return to trading stability above the resistance-turned-support level at 1.2660 could lead to a temporary recovery in the pair’s value. In such a scenario, the pair may retest the pivotal resistance at 1.2730.

Conclusion and Tactical Considerations

Navigating Bearish Pressure

As the GBP/USD pair grapples with significant losses and technical pressures, traders should exercise caution and closely monitor key support and resistance levels. Adapting strategies to align with prevailing market dynamics and implementing stringent risk management protocols will be essential for navigating the bearish environment effectively. Staying updated on relevant market news and developments will also aid in making informed trading decisions amidst the ongoing volatility in the currency pair.

A cautionary note is warranted as the risk level is deemed high, underscoring the importance of vigilance in the current market conditions.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations