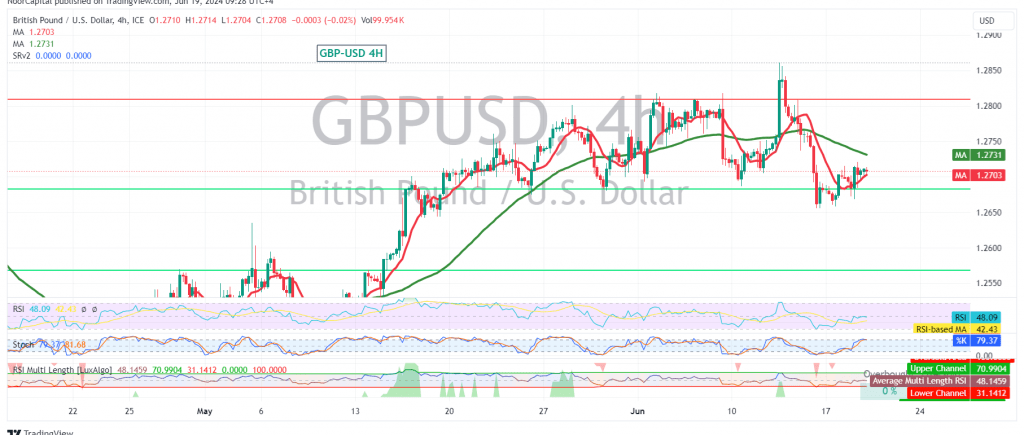

The British pound (GBP) is showing limited positive movement against the US dollar (USD), attempting to consolidate above the key psychological resistance level of 1.2700.

Technical Outlook:

The current price action indicates stability above 1.2700, which supports a positive outlook. However, the 50-day simple moving average is still exerting downward pressure from above, warranting caution.

Upward Potential:

We lean towards a positive outlook, with a target of 1.2750 as the first resistance level. A break and consolidation above 1.2750 could trigger a further rise towards 1.2780 and 1.2830.

Downside Risks:

Traders should be vigilant as a drop below 1.2675 would invalidate the bullish scenario and could lead to a decline towards 1.2630.

Important Note:

The release of highly sensitive UK economic data today, specifically the annual consumer price index (CPI), could induce significant price volatility. Traders should exercise caution and closely monitor the market’s reaction to this data release.

Key Levels:

- Support: 1.2675, 1.2630

- Resistance: 1.2700, 1.2750, 1.2780, 1.2830

Disclaimer: Trading in CFDs carries inherent risks. The analysis provided herein is not a recommendation to buy or sell, but rather an interpretation of the current price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations