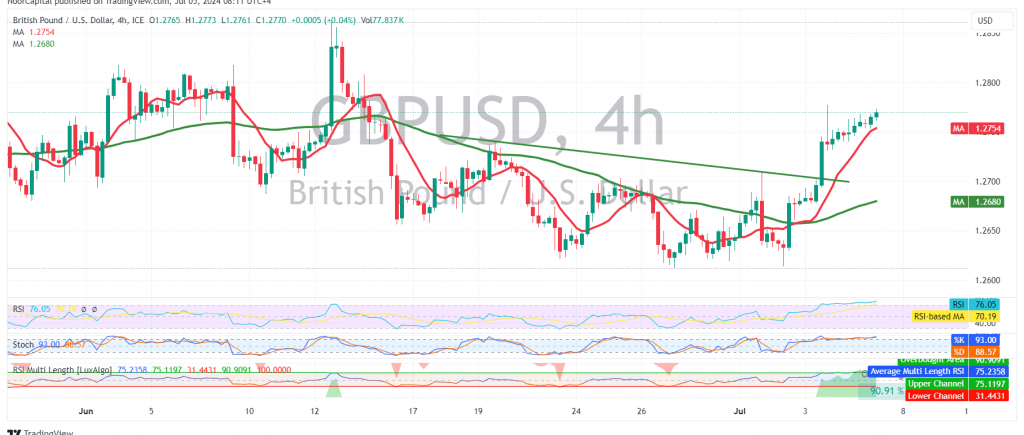

The British pound (GBP) demonstrated a strong upward trend against the US dollar (USD) in the previous trading session, reaching our previously identified target of 1.2750 and peaking at 1.2778.

Technical Outlook:

Today’s technical analysis reveals a continuation of the bullish momentum. The pair is holding firmly above the previously breached resistance level of 1.2710, which is now acting as a support level. Additionally, the 50-day simple moving average (SMA) is providing positive support, and the Relative Strength Index (RSI) remains above the 50 midline, further confirming the bullish bias.

Upward Potential:

With the current bullish momentum and strong support, we anticipate further upside movement in today’s trading session. The initial target is 1.2810, followed by a potential extension towards 1.2850. A break above 1.2850 could propel the pair towards 1.2900.

Downside Risks:

However, traders should remain cautious as a confirmed break below 1.2710 could invalidate the bullish scenario and lead to a bearish reversal, targeting 1.2640.

Key Levels:

- Support: 1.2710, 1.2640

- Resistance: 1.2810, 1.2850, 1.2900

Important Note:

The release of high-impact U.S. economic data today, including non-farm payrolls, unemployment rate, and average hourly earnings, could induce significant price volatility. Traders should closely monitor the market’s reaction to these data releases.

Disclaimer: This analysis is for informational purposes only and should not be considered as financial advice.

Disclaimer: Trading in CFDs carries inherent risks. The analysis provided herein is not a recommendation to buy or sell, but rather an interpretation of the current price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations