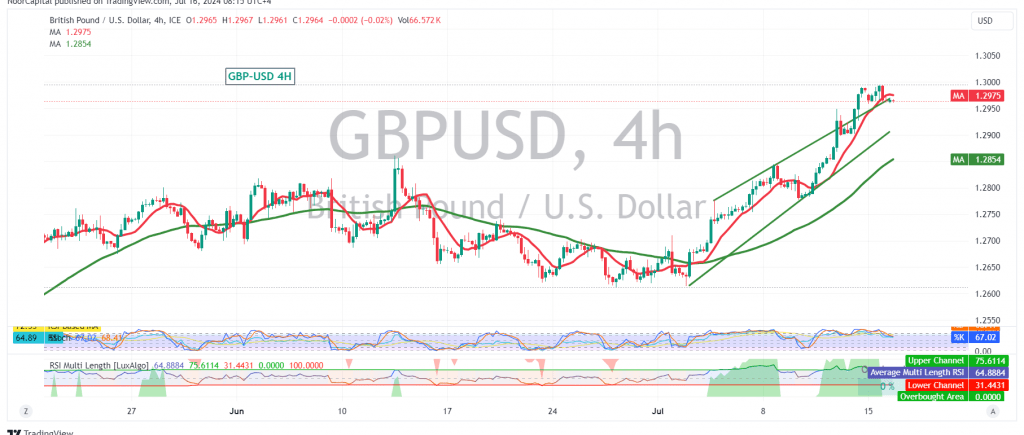

The British pound (GBP) has continued its upward trajectory against the US dollar (USD), exceeding our previous target of 1.2960 and approaching the key psychological level of 1.3000.

Technical Outlook:

On the 4-hour chart, the simple moving averages (SMAs) are still providing support for the upward movement, suggesting continued bullish momentum. However, the Stochastic oscillator is showing signs of potential negative divergence, warranting caution.

Upward Potential:

As long as the price remains above the 1.2920 support level, the bullish trend is expected to persist. The initial target is 1.3000, followed by potential further gains towards 1.3030 and 1.3070.

Downside Risks:

Traders should remain vigilant as a break below 1.2920 could trigger a temporary correction and invalidate the bullish scenario.

Key Levels:

- Support: 1.2920

- Resistance: 1.3000, 1.3030, 1.3070

Important Note:

The release of high-impact U.S. economic data today, including monthly retail sales and core retail sales excluding cars, could induce significant price volatility. Traders are advised to closely monitor the market’s reaction to these data releases.

Disclaimer: Trading in CFDs carries inherent risks. The analysis provided herein is not a recommendation to buy or sell, but rather an interpretation of the current price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations