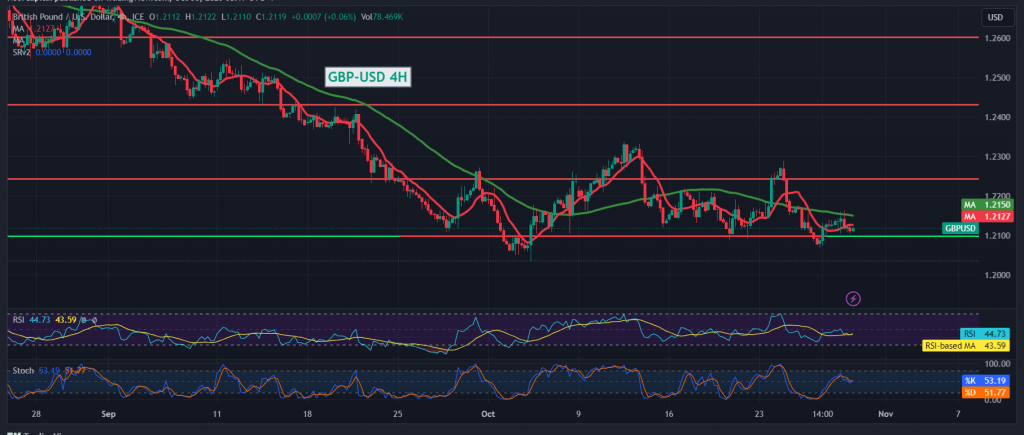

The pound/dollar pair remains firmly entrenched beneath the robust resistance level of 1.2170, exerting downward pressure on the pair’s movements. Presently, the market exhibits stability near its morning low, hovering around 1.2120.

In today’s technical analysis, a pessimistic outlook prevails, driven by the pair’s sustained trading below 1.2145, particularly 1.2170. This bearish sentiment is accentuated by the re-emergence of the simple moving averages, applying pressure from above. These factors are compounded by the unequivocal negative signals emitted by the Stochastic indicator.

Given these indicators, the possibility of a continued decline looms large. It’s worth noting that breaching the 1.2090 mark would considerably ease the path toward revisiting 1.2045. A break below this level would intensify the negative pressure, potentially leading to a touchpoint at 1.2010—unless a decisive upward movement above 1.2170 materializes. Market participants are advised to monitor these critical levels for informed trading decisions closely.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations