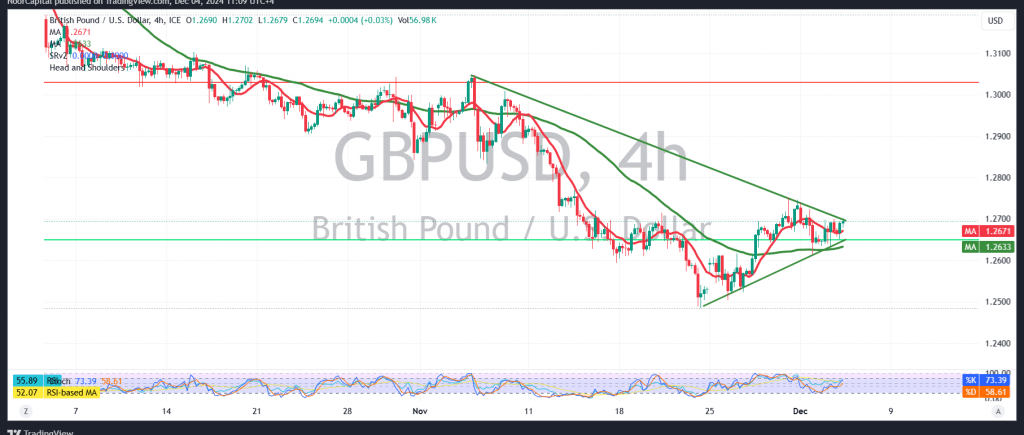

The British pound experienced negative trading against the U.S. dollar following a retest of the psychological resistance level at 1.2700.

Technical Analysis:

The bearish outlook prevails, supported by the technical structure on the 4-hour chart and the stability of the pair below the significant resistance level of 1.2730.

Scenario Analysis:

- Bearish Case: The downward trend is favored, targeting 1.2655 and 1.2630. A break below 1.2630 could intensify bearish momentum, paving the way toward 1.2540.

- Bullish Case: Stability above 1.2730 invalidates the bearish scenario, allowing the pair to resume its upward path with targets at 1.2770 and 1.2805.

Warning: The release of high-impact U.S. economic data, including “Non-Farm Private Sector Jobs Change,” “ISM Services PMI,” and a speech by Federal Reserve Chairman Jerome Powell, could lead to significant market volatility.

Warning: Risk levels remain elevated amid ongoing geopolitical tensions, making all scenarios possible.

Disclaimer: Trading in CFDs carries inherent risks. The analysis provided herein is not a recommendation to buy or sell, but rather an interpretation of the current price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations