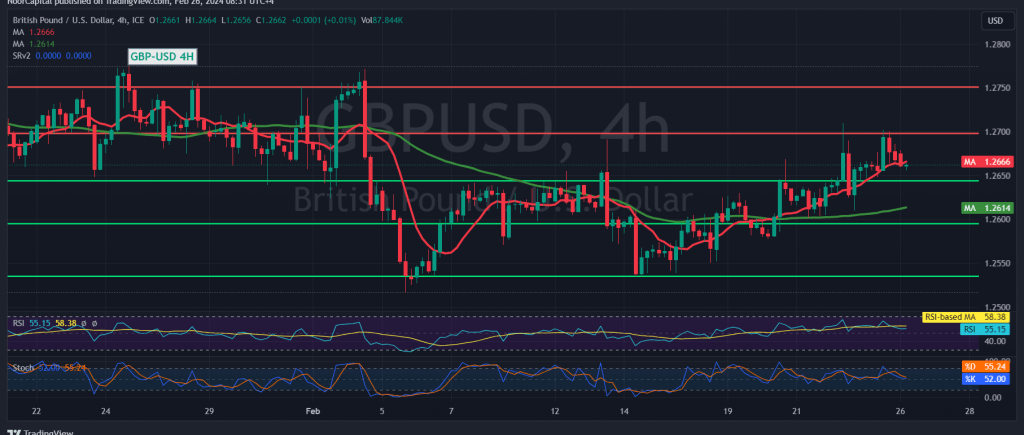

During last Friday’s trading session, the British pound exhibited an upward trajectory against its American counterpart, marking a notable breakthrough above the pivotal resistance level of 1.2650. This advancement allowed the pair to reach the initial official target at $1.2710, reaching a peak of $1.2702.

Today, from a technical standpoint, there’s a cautious optimism as the pair endeavors to stabilize intraday above the critical level of 1.2650. The 50-day simple moving average is indicating upward pressure, complemented by positive signals emerging from the Momentum indicator.

Consequently, the prospect of an upward trend prevailing in today’s trading session remains plausible and impactful, with the initial target set at 1.2690. A breach above this level serves as a catalyst, heightening the likelihood of touching 1.2720 and subsequently 1.2750.

However, any hourly candle closing below 1.2640 might temporarily postpone the upward trajectory without nullifying it entirely. In such a scenario, a mild bearish bias may prompt a retest of 1.2610 before resuming the upward momentum.

By staying attuned to critical levels and potential reversal scenarios, traders can navigate the fluctuations within the pound sterling-US dollar pair with heightened precision and confidence.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations