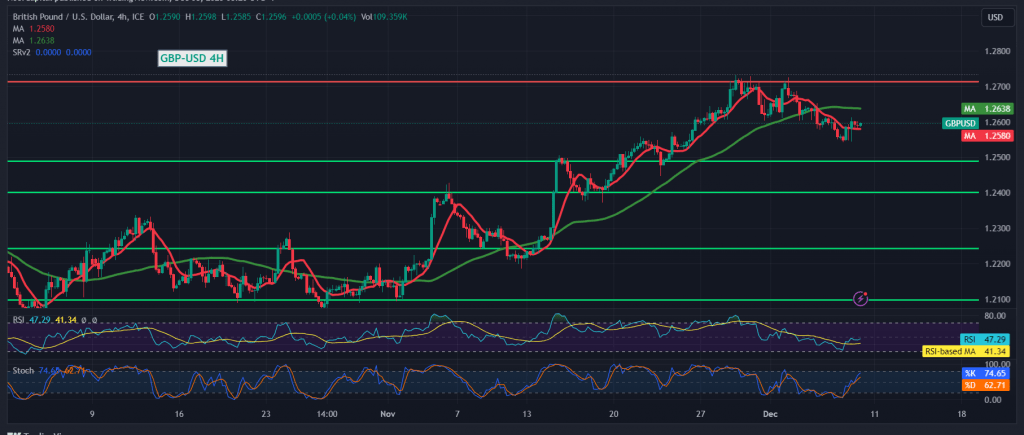

Limited positive trading regained control of the pound sterling against the US dollar in the recent session, leveraging support at 1.2540. A subsequent decline prompted a rebound, approaching a retest of the psychological barrier at 1.2600.

Examining the technical aspects today, our trading stance tends towards negativity, contingent on intraday stability below the psychological resistance levels of 1.2600, particularly emphasizing 1.2620. This cautious approach aligns with sustained negative pressure from the 50-day simple moving average.

Consequently, the potential for a resurgence of the downward bias remains viable, especially if the pair slips below 1.2550, facilitating a journey towards the initial target at 1.2510, followed by 1.2480.

Conversely, a scenario of price consolidation above 1.2620 would promptly halt the bearish narrative, paving the way for a positive trading session. In such a case, targets at 1.2650 and 1.2690 become pertinent.

A crucial advisory note: Today’s anticipation of high-impact economic data from the American economy, specifically NFP sector jobs data, average wages, and unemployment rates, introduces the potential for substantial price fluctuations during the news release. Exercise caution and remain vigilant in response to market dynamics.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations