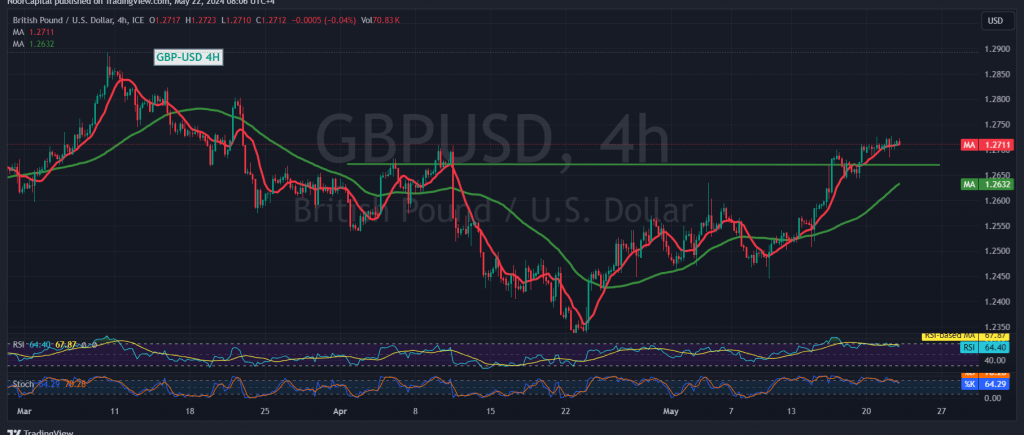

Positive trading dominated the movements of the pound sterling against the US dollar, maintaining positive stability and recording a high of 1.2727.

Technical Analysis

Examining the 4-hour chart reveals the following:

- Stochastic Indicator: Showing potential for more positive momentum, which could push the pair upward.

- 50-Day Simple Moving Average: Price stability above this level supports the bullish outlook.

Upward Targets

The potential for an upward trend remains strong, with key targets as follows:

- First Target: 1.2750.

- Second Target: 1.2800.

Critical Support Level

Price consolidation above the psychological barrier at 1.2700 is crucial for maintaining the bullish scenario.

Downside Risk

If the price falls below 1.2700, the bullish scenario could be invalidated, leading to negative pressure with targets at:

- First Target: 1.2650.

- Second Target: 1.2630.

Market Volatility Alert

Today, significant market volatility is expected due to the release of critical economic data from the United States, particularly the Federal Reserve Committee meeting results.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations