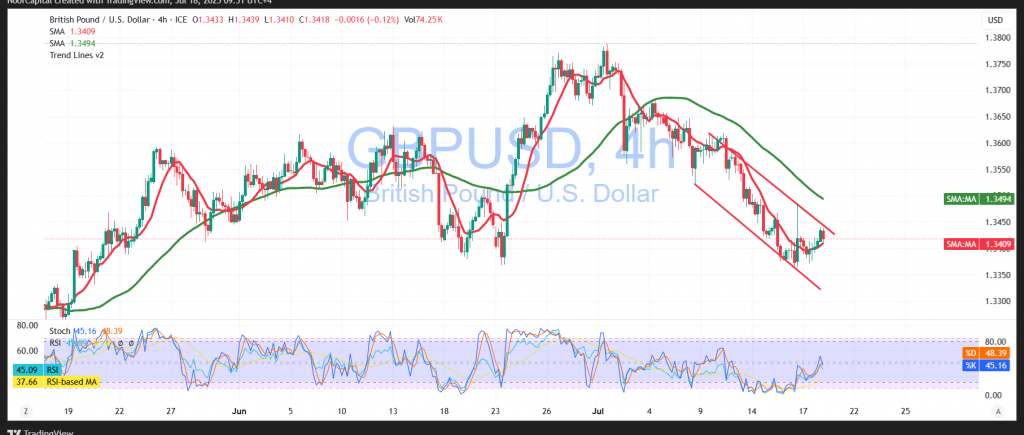

The British pound is attempting a limited intraday rebound against the U.S. dollar, forming part of a partial correction after the losses recorded in the previous session. However, these movements remain constrained within a narrow range, reflecting continued bearish pressure.

Technical Outlook – 4-Hour Timeframe:

The pair remains under pressure from the simple moving averages, which act as dynamic resistance levels and continue to cap any recovery attempts. Notably, the 50-period moving average aligns with the 1.3480 resistance level, reinforcing its technical significance. Meanwhile, the Relative Strength Index (RSI) is showing mild positive signals after entering oversold territory, which could support a temporary rebound in the short term.

Probable Scenario – Bearish Bias:

As long as the price remains below 1.3450, and more importantly below 1.3460, the bearish scenario is favored. A confirmed break below 1.3400 would likely accelerate the decline toward:

- 1.3360, followed by

- 1.3305 as the next support level

Alternative Scenario – Short-Term Recovery:

If the pair manages to break above 1.3480 and hold, this could mark an initial signal of a potential recovery, with upside targets at:

- 1.3540 as a resistance to watch

Caution:

The risk level remains high amid ongoing geopolitical and trade tensions. Traders should prepare for potential volatility, and apply disciplined risk management, as all scenarios remain on the table.

Disclaimer: Trading in CFDs carries inherent risks. The analysis provided herein is not a recommendation to buy or sell, but rather an interpretation of the current price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations