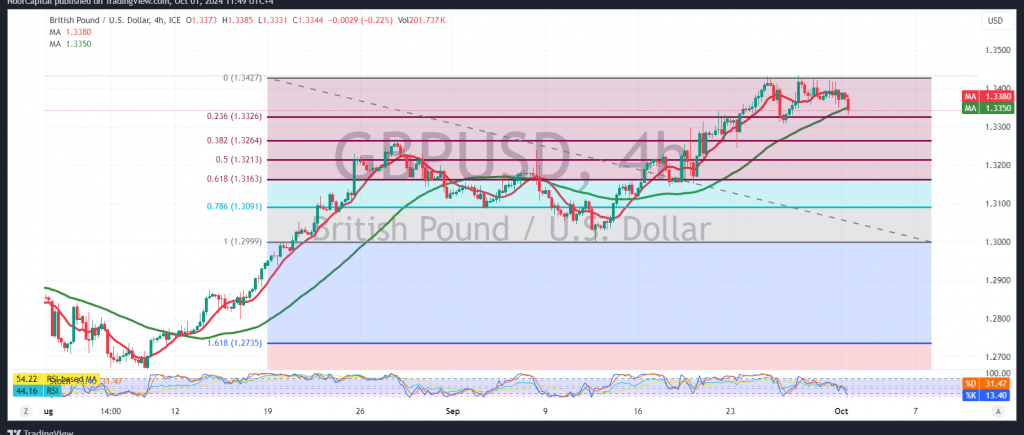

The British pound against the US dollar remains confined within a narrow sideways trading range, capped by resistance at 1.3430 and supported at 1.3300.

From a technical perspective, analyzing the 240-minute chart, the 50-day simple moving average continues to provide upward support, and we anticipate the Stochastic indicator gaining additional momentum, which could sustain the upward trend.

Therefore, as long as daily trading remains above 1.3310, the possibility of an upward trend continues in the coming hours, with an initial target of 1.3405, followed by 1.3465, and potentially extending to 1.3500.

It’s important to note that if trading stability drops below 1.3300, it would halt any upward attempts, subjecting the pair to strong negative pressure with potential declines towards 1.3275 and 1.3210.

Warning: Today, we anticipate high-impact economic data from the US, particularly the “Job Vacancies and Labor Turnover” report, which could cause significant price volatility.

Warning: The risk level is elevated amidst ongoing geopolitical tensions, and all scenarios remain possible.

Disclaimer: Trading in CFDs carries inherent risks. The analysis provided herein is not a recommendation to buy or sell, but rather an interpretation of the current price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations