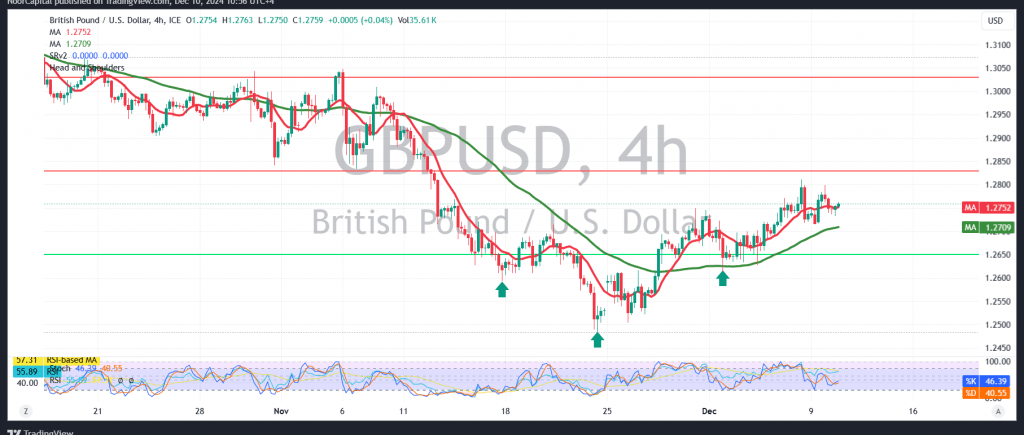

The British pound exhibited positive attempts against the US dollar as anticipated, successfully achieving the first target of 1.2785 and reaching a peak near the psychological barrier of 1.2800.

On the technical front today, a cautiously optimistic outlook prevails, supported by the bullish structure visible on the 4-hour chart and the pair’s persistence above the 50-day simple moving average.

With trading stable above 1.2730, and more importantly 1.2710, the bullish scenario remains intact, targeting 1.2785 and 1.2845 consecutively. Breaching the 1.2845 level could intensify the upward momentum, paving the way for a direct climb towards 1.2865.

Conversely, if trading stabilizes below 1.2710, it would negate the proposed bullish outlook, shifting the trend back to bearish with targets at 1.2670 and 1.2630.

Warning: Elevated risks persist amid ongoing geopolitical tensions, and all scenarios remain plausible.

Disclaimer: Trading in CFDs carries inherent risks. The analysis provided herein is not a recommendation to buy or sell, but rather an interpretation of the current price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations