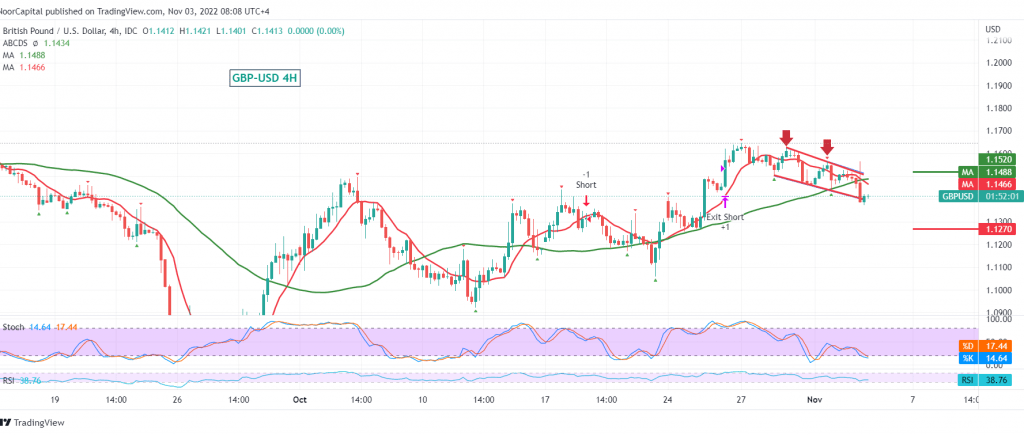

The British pound declined noticeably yesterday within the expected negative technical outlook, in which we relied on the beginning of the regular movement within a bearish intraday channel, touching the official target of 1.1375, recording the lowest 1.1375.

On the technical side, we tend in our trading to the negative, relying on confirming the pair’s breach of the main support floor of 1.1520 and then proving the breach of 1.1480, the previously broken support, which meets around the 50-day simple moving average.

We tend to resume the decline, knowing that the decline below 1.1375 constitutes a negative pressure factor that opens the door towards 1.1340 and 1.1265, awaited targets, unless we witness any consolidation of the price above 1.1530.

Note: BoE Governor Speech, BoE Rate Decision, Monetary Policy Summary and Policy Report are due today ”. They have a significant impact on the pair’s movements and we may witness high volatility in prices.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: 1.1340 | R1: 1.1530 |

| S2: 1.1265 | R2: 1.1640 |

| S3: 1.1150 | R3: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations