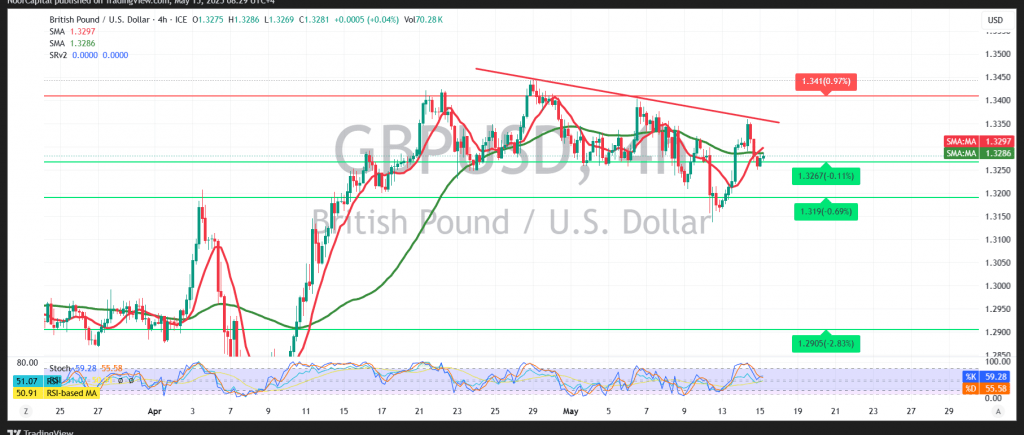

The British pound is exhibiting a clear downward bias against the U.S. dollar after encountering strong resistance near the 1.3360 level, which triggered renewed selling pressure.

From a technical perspective, the 4-hour chart shows that the simple moving averages are now exerting downward pressure, acting as a dynamic resistance zone. Additionally, the Relative Strength Index (RSI) remains below the neutral 50 level, supporting a bearish near-term outlook.

A break below the key support level at 1.3260 would likely reinforce the bearish scenario, exposing the pair to further downside toward 1.3235, followed by 1.3190. This outlook remains valid as long as the pair stays below the 1.3345 resistance threshold.

However, if price action recovers and stabilizes above 1.3345, the current bearish trend may be temporarily invalidated, opening the door for a potential retest of the 1.3400 resistance level.

Key Event Risk Today:

Several high-impact U.S. economic indicators are scheduled for release, including:

- Retail Sales

- Producer Price Index (PPI)

- Unemployment Claims

- Speech by a Federal Reserve Governor

These events may trigger substantial market volatility.

Risk Disclaimer: Given the backdrop of ongoing global trade tensions and critical economic data releases, risk levels are elevated. Traders should remain vigilant and prepared for sharp intraday movements.

Disclaimer: Trading in CFDs carries inherent risks. The analysis provided herein is not a recommendation to buy or sell, but rather an interpretation of the current price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations