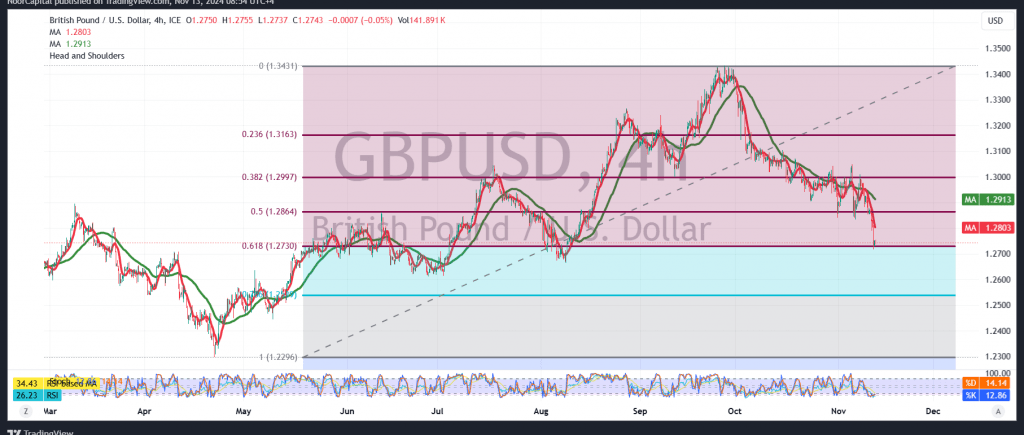

The British pound experienced a pronounced downtrend against the US dollar, consistent with the bearish outlook outlined in the previous technical report. The pair hit the official target of 1.2730, reaching a low of 1.2719.

Looking at the technicals for today, the 4-hour chart shows the pair attempting to bounce upward after touching the 1.2735 support level, which aligns with the 61.80% Fibonacci retracement. This support increases the potential for an upward move. However, the simple moving averages remain positioned above the price, exerting downward pressure and supporting a continued bearish trend.

Our outlook remains cautiously bearish, with confirmation needed for a break below 1.2710 to pave the way for a move towards 1.2665. Should selling pressure persist, losses may extend further to 1.2630.

Conversely, if the pair manages to sustain trading above 1.2765 and close an hourly candle at that level, we could see a short-term upward attempt, aiming to retest 1.2800 and potentially 1.2840.

Caution: The release of high-impact economic data from the US, including the “Consumer Price Index – Annual and Monthly,” could lead to significant price volatility.

Risk Alert: Elevated risk levels persist due to ongoing geopolitical tensions, and various market scenarios remain possible.

Disclaimer: Trading in CFDs carries inherent risks. The analysis provided herein is not a recommendation to buy or sell, but rather an interpretation of the current price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations