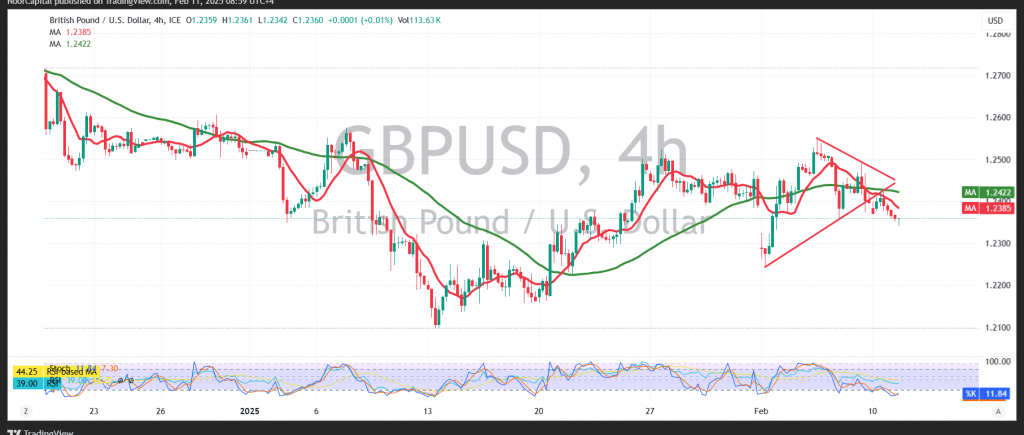

The British pound traded in a narrow sideways range against the U.S. dollar, fluctuating between 1.2310 (support) and 1.2410 (resistance) during the previous session.

Technical Outlook:

- The pair is trading below the simple moving averages, exerting downward pressure on the price.

- Bearish Scenario:

- A clear break below 1.2310 could confirm a downtrend, with initial targets at 1.2295 and 1.2250.

- Bullish Scenario:

- If the price stabilizes above 1.2410, it could trigger a short-term recovery, targeting 1.2455 and 1.2485.

Market Risks & Considerations:

- Federal Reserve Chairman Jerome Powell’s testimony today could cause high volatility in GBP/USD movements.

- Ongoing trade tensions contribute to elevated risk levels.

⚠ Risk Warning: The market remains uncertain, and all scenarios are possible.

Disclaimer: Trading in CFDs carries inherent risks. The analysis provided herein is not a recommendation to buy or sell, but rather an interpretation of the current price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations