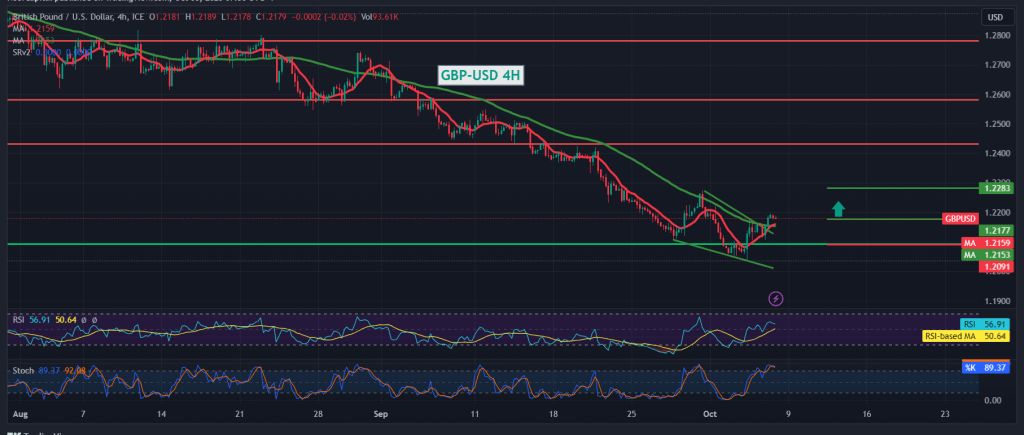

Quiet positive trading dominated the movements of the pound sterling against the US dollar, benefiting from maintaining its positive stability above the support level of 1.2110. The current movements witnessed stability above the resistance level of 1.2170.

On the technical side today, by looking at the 4-hour chart, we find the simple moving averages trying to support the upward attempts, and this comes in conjunction with the positive signs that have begun to appear on the 14-day momentum indicator.

There may be a possibility to continue the rise with confirmation of the pair breaching the 1.2170 resistance level, targeting 1.2215 and 1.2260 respectively, noting that trading stability above 1.2130 is a condition for activating the proposed scenario.

The price sneaking below 1.2130 will immediately stop attempts to rise and lead the pair to complete the official bearish path, with targets starting at 1.2070 and 1.2030 initially.

Note: Stochastic is around overbought areas and we may witness some fluctuation until we obtain the desired direction.

Note: Today, we are awaiting high-impact economic data issued by the American economy, “US jobs data (NFP), average wages and unemployment rates, and we may witness high price fluctuation when the news is released.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations