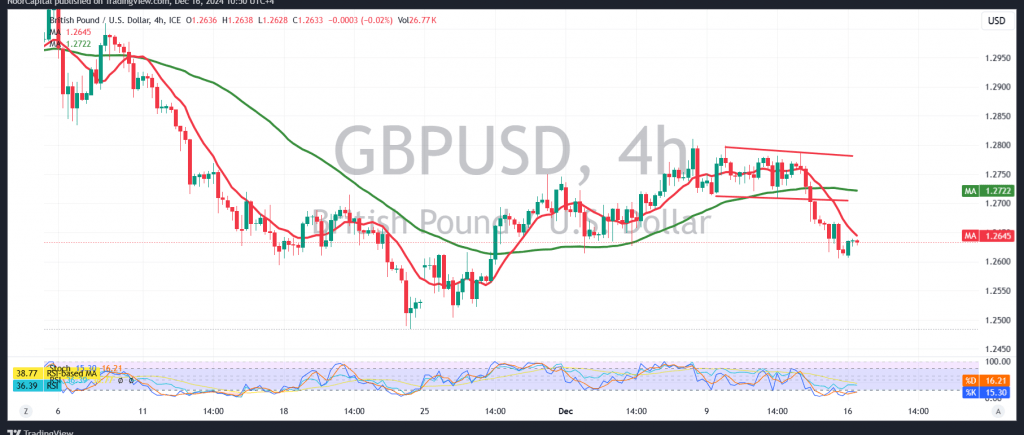

The British pound faced strong resistance near 1.2680, which pushed it into negative territory by the end of last week’s trading, reaching a low of 1.2608.

From a technical perspective today, a cautious bearish bias remains the preference, supported by the pair’s intraday trading stability below the 1.2680 level, and more broadly under the main resistance at 1.2730. This is reinforced by continued negative pressure from the simple moving averages.

Thus, the downward trend is the most probable scenario for today’s session, with targets at 1.2600. Breaking below this level could pave the way toward the next targets at 1.2565 and 1.2530.

However, if trading stabilizes again above 1.2730, the bearish outlook would be invalidated, and the pair could resume an upward trajectory, with initial targets at 1.2750 and 1.2780.

Warning: The risk level is elevated due to ongoing geopolitical tensions, making all scenarios possible.

Disclaimer: Trading in CFDs carries inherent risks. The analysis provided herein is not a recommendation to buy or sell, but rather an interpretation of the current price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations