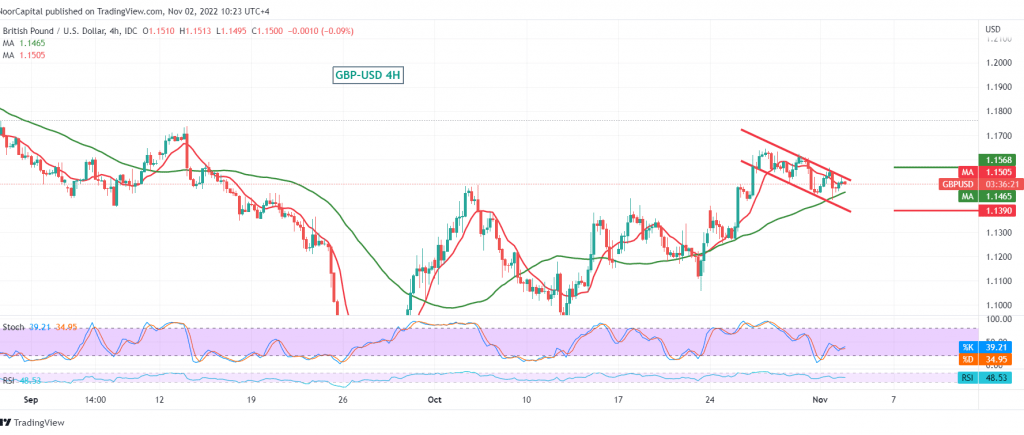

Trading tilted to the negative and started to control the movements of the British pound against the US dollar after it found a resistance level of around 1.1560/1.1550.

On the technical side, the pair starts moving within a bearish channel today, and we find the 50-day simple moving average, which begins with negative pressure on the price from above, motivated by the negativity of the stochastic indicator.

We tend to descend cautiously, targeting 1.1440 first target, noting that the confirmation of the pair’s breach of the mentioned support level extends the negative pressure so that we are waiting for 1.1375 next station.

Consolidation above 1.1560 leads the pair to recover again, targeting a retest of 1.1630.

Note: Investors will monitor the central bank’s statement and Fed Chair Jerome Powell’s press conference. They have an essential impact on markets, and we may witness high volatility.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: 1.1440 | R1: 1.1565 |

| S2: 1.1375 | R2: 1.1630 |

| S3: 1.1310 | R3: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations