Negative trading dominated the movements of the pound sterling against the US dollar to give up its expected gains during the previous analysis, touching the stop-loss order published yesterday at the price of 1.2175, recording its lowest level at 1.2135.

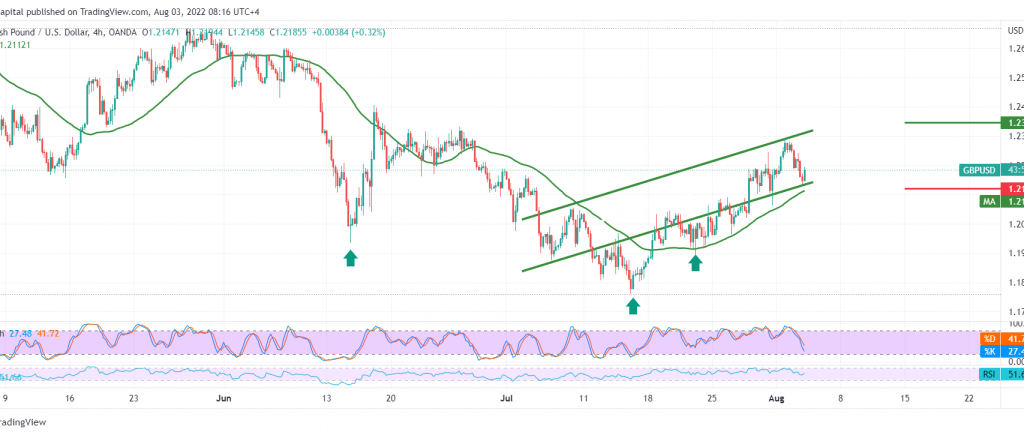

Technically and carefully considering the 240-minute chart, the simple moving average still supports the bullish price curve, as we find the pair stable above the bullish price channel support shown on the chart, which increases the possibility of a rise in the coming hours.

We tend to be positive but cautiously, with daily trading remaining above 1.2120, targeting 1.2270 first target, considering that consolidation above 1.2270 can consolidate the pair’s gains, opening the door towards 1.2340 as the next station.

We remind you that breaking 1.2120 constitutes a strong negative pressure factor on the pair and initially leads the price to visit 1.2060.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations