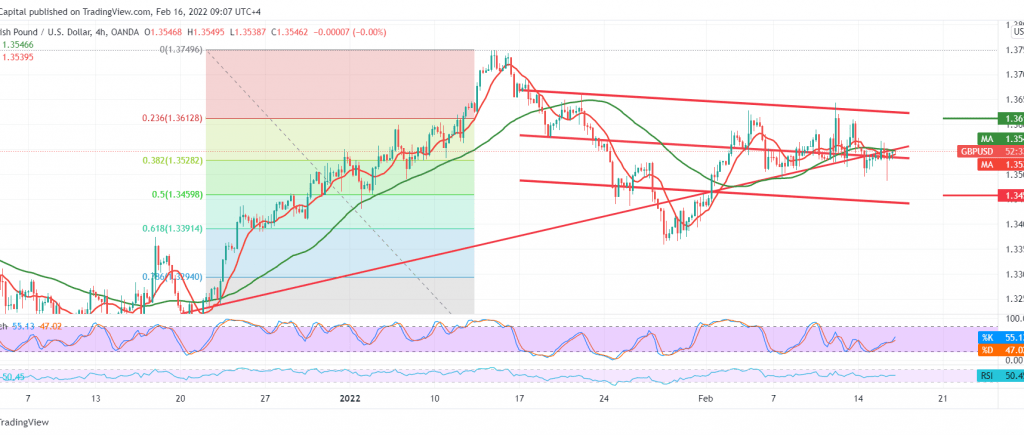

The British pound’s movements witnessed a bearish tendency after it failed to stabilize for a long time above the pivotal resistance 1.3610, which formed a negative obstacle in front of the pair.

Technically, with trading remaining below 1.3600, and most importantly 1.3610 represented by the 23.60% Fibonacci correction, as indicated on the 4-hour chart, coinciding with the clear negativity on the momentum indicator.

This makes it possible to retest 1.3500, knowing that confirming the breach of the target level puts the pair under negative pressure to visit the 1.3460 area, 50.0% Fibonacci retracement as a next stop unless we witness any trading above 1.3610.

Attempts to consolidate and breach the resistance level 1.3610 may thwart the descending slope, and the British pound will recover to visit 1.3660.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: 1.3500 | R1: 1.3580 |

| S2: 1.3460 | R2: 1.3610 |

| S3: 1.3410 | R3: 1.3660 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations