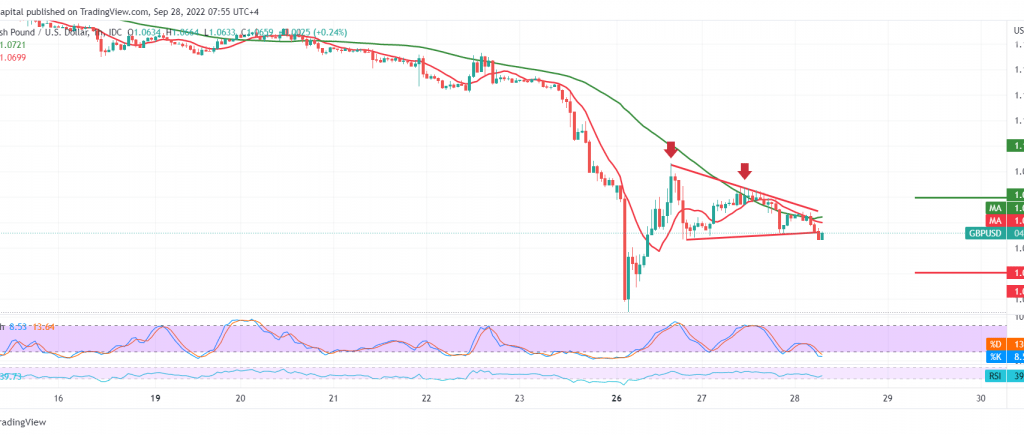

We adhered to intraday neutrality during the previous analysis due to the instability of the GBPUSD price. However, the current movements of the pair are witnessing the continuation of the effect of the bearish directional movement, settling near its lowest level during the early trading of the current session at 1.0640.

Technically, and with the continuation of the negative pressure of the simple moving averages that pressure the price from above, the 50-day average meets around 1.0740 resistance, adding more strength to it, in addition to the negative signals coming from the RSI on the short time frames.

Therefore, resuming the decline may be valid. Still, we need to witness a break of 1.0630 to target 1.0600 and 1.0580, respectively, taking into account that the decline below 1.0580 increases and accelerates the strength of the daily bearish trend to be waiting for 1.0510.

Consolidating above 1.0740 might lead the pair to a limited recovery attempt, starting with its initial targets around 1.0790.

Note: Markets are still unstable, and we may see random moves.

Note: We are awaiting the Federal Reserve’s speech later in today’s session, and we may witness high price volatility.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations