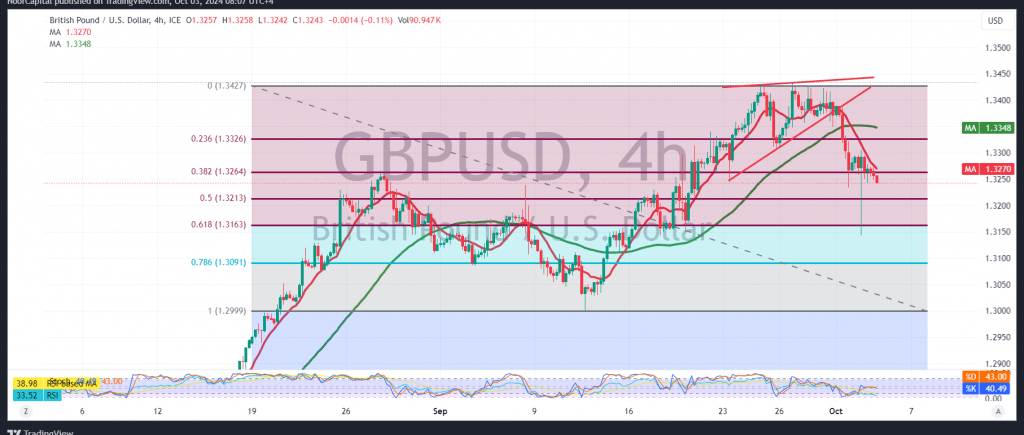

A bearish trend took hold of the British pound against the US dollar after failing to maintain its trading position above 1.3300, pushing the pair under negative pressure and leading it to touch a low of 1.3246 during morning trading.

Technically, there is a likelihood of continued bearish movement in the coming hours, supported by the break below the psychological barrier of 1.3300 and further reinforced by the negative crossover in the simple moving averages.

With this in mind, we target 1.3210 as the first key level, coinciding with the 50% Fibonacci retracement. It’s important to monitor the price around this level closely, as breaking it could accelerate the decline toward 1.3165.

Conversely, if the pair stabilizes and trades back above 1.3300, it would halt the bearish trend and allow for a recovery toward 1.3325 and 1.3355.

Warning: High-impact US economic data, including “Unemployment Claims” and “ISM Services PMI,” is expected today, which may lead to significant price volatility.

Risk Warning: The risk level is elevated due to ongoing geopolitical tensions, and all scenarios remain possible.

Disclaimer: Trading in CFDs carries inherent risks. The analysis provided herein is not a recommendation to buy or sell, but rather an interpretation of the current price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations