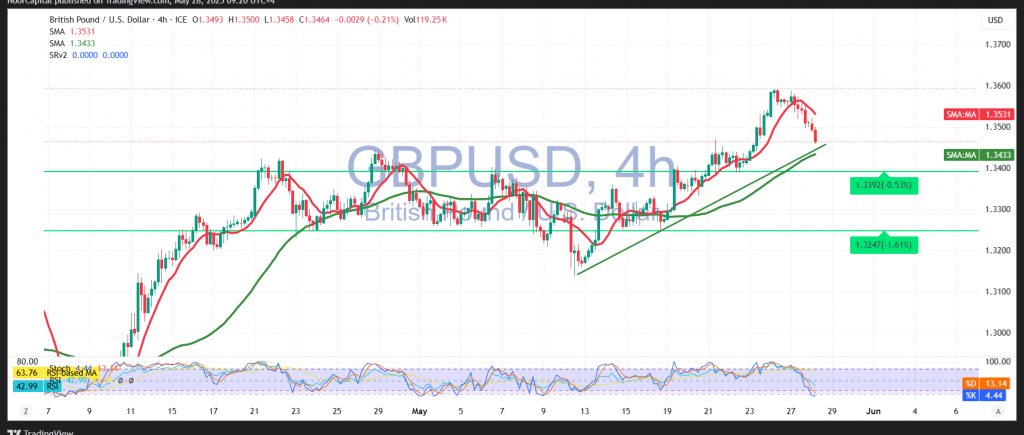

After a series of consecutive gains, the British pound has retraced its recent highs against the U.S. dollar, pulling back from the 1.3580 resistance level, which capped further upside. Intraday movements have since stabilized near the morning low of 1.3470.

From a technical perspective, while intraday momentum remains somewhat muted, simple moving averages continue to provide underlying support for the uptrend. The Relative Strength Index (RSI) is also showing signs of recovery after reaching oversold conditions, suggesting the potential for renewed upward momentum.

As long as price action remains above 1.3430, the broader bullish trend remains intact, with initial upside targets at 1.3530 and 1.3550. A confirmed break above these levels could open the door for a further advance toward 1.3590.

However, a return to trading below 1.3430, particularly with an hourly candle close, would likely limit the upside potential and place the pair under renewed selling pressure. In this scenario, the next downside targets are 1.3390 and 1.3340.

Key Event Risk Today:

Traders should prepare for potential high volatility surrounding the release of the Federal Reserve meeting minutes, a high-impact event that could influence global FX markets, including GBP/USD.

Risk Disclaimer:

Amid persistent trade tensions and global economic uncertainty, risk levels remain high. Traders are advised to exercise caution and remain flexible, as rapid market shifts remain possible.

Disclaimer: Trading in CFDs carries inherent risks. The analysis provided herein is not a recommendation to buy or sell, but rather an interpretation of the current price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations