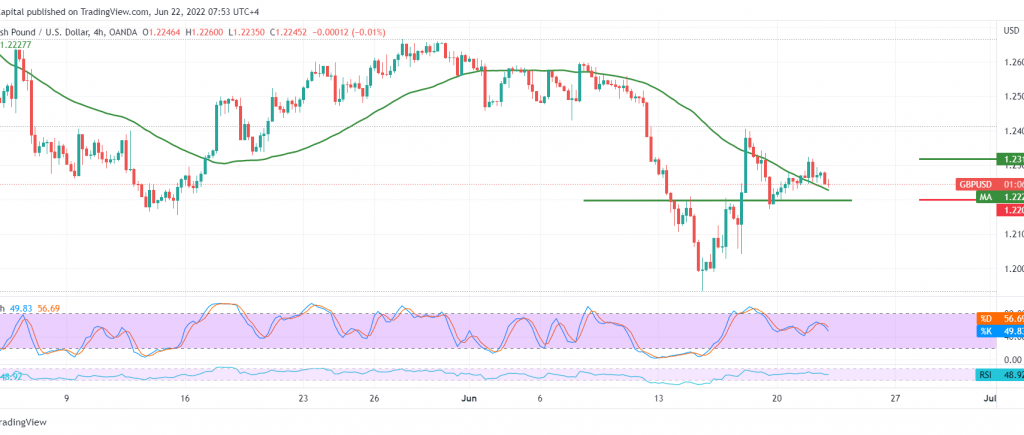

The British pound made attempts to rise yesterday. However, there are still limited attempts, and it is gradually approaching the first target that must be touched during the last analysis, 1.2370, to be satisfied with recording its highest price at 1.2346.

Technically, despite the clear negative signs on the stochastic indicator, which is accompanied by a decline in the bullish momentum, the pair is still stable above the 50-day simple moving average, in addition to the stability of trading above the psychological barrier 1.2200 support, accompanied by the bullish technical formation shown on the 4-hour chart.

We tend to rise, but cautiously, steadily trading above 1.2200, targeting 1.2310, considering that a breach to the upside has a catalyst that can enhance the chances of rising to visit 1.2385.

We remind you that trading stability above 1.2200 is essential to activating the suggested bullish scenario. Breaking it will renew the chances of controlling the bearish trend with an initial target of 1.2165, and it may extend later towards 1.2110.

Note: Today we are awaiting high-impact data from the British economy “Consumer Price Index” and we may witness high volatility in prices.

Note: The testimony of “Jerome Powell” Chairman of the Federal Reserve is due today, and we may witness high volatility.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations