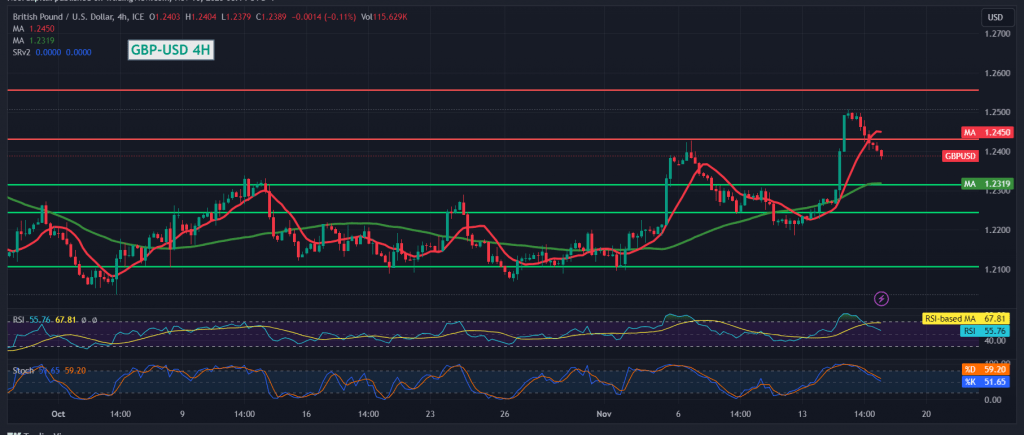

The downward trend has reclaimed dominance over the Pound Sterling’s movements against the US Dollar, following its failure to breach the key resistance level at 1.2500. We clarified that surpassing this level is essential for the continuation of the rise, and that a dip below 1.2420 would immediately halt this upward trajectory, prompting the pair to embark on a downward course.

Today’s technical analysis reveals that with trading persisting below 1.2420, combined with the re-emergence of simple moving averages exerting downward pressure on the price, there are clear negative signals on the relative strength index.

Consequently, there is a viable and active possibility of a bearish trend during the upcoming hours, aiming for a retest of the robust support level of 1.2345 before determining the next price direction. It’s imperative to note that breaching this level could directly pave the way towards 1.2300.

Conversely, an upward move and price consolidation above 1.2420, and more importantly 1.2465, could completely activate the bearish scenario and prompt the pair to recover towards 1.2500 and 1.2540.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations